Buy Tech Mahindra Ltd for the Target Rs. 1821 by Nirmal Bang Ltd

Introduction

Tech Mahindra is a leading IT and consulting firm with focus on Telecom (33%), BFSI (16.5%), manufacturing (17%), HiTech, Healthcare, etc. verticals. Co has demonstrated continued progress in its transformation journey initiated in FY23 under the leadership of Mohit Joshi (ex-Infosys). Apart from aiming margin expansion, Co also focused on acquiring high-quality profitable large clients which all turned out positive for the Co’s performance.

Macro Industry Outlook

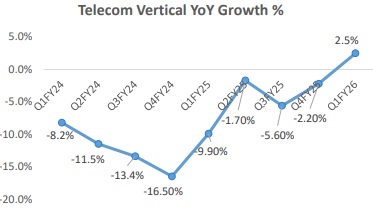

Macro Environment has been jittery and uncertain amidst tariffs and geopolitical wars. Specific to TechM, Co has seen slowdown in manufacturing with cutbacks in discretionary spending, weakness in Hi-Tech continues due to client-specific issues, particularly among semiconductor clients. Positively, the Telecom vertical (largest vertical) has stabilized and seen a growth of 2.5 % YoY in Q1FY26. In Europe Co is seeing vendor consolidation deals.

The Americas geography has historically been challenging for Tech M and it saw sharp reductions in spending from the largest clients. It believes that spending has now stabilized and growth in telecom will be seen in this geography in the coming quarters.

Technology Up gradation in forefront

To remain AI enabled, TechM has created a few partnerships which include a partnership with Nuix, a global leader in AIpowered investigative analytics and intelligence software to provide innovative, scalable solutions for cyber and fraud detection. It has also partnered with Service Now to deliver nextgenbroadbandsolutionstailoredforCSPs,offer

Steady Improvement backed by TCVs

Company’s performance has steadily strengthened, reflecting disciplined execution and a focused strategy. Even in uncertain macro environment, Co has been able to expand margins in the past 7 consequent quarters. EBIT Margins have improved from 5.4% in Q3FY24 To 11.1% in Q1FY26. And management is confident of reaching the guided margin of 15% by FY27.

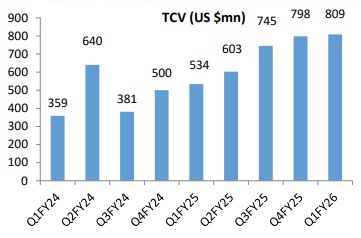

On revenue front, Management maintains that FY26 will be better than FY25 and expects better than industry growth in FY27 as well backed by focus on profitable large deals. The Net new deal TCV was $809 mn in Q1FY26 which was up 1.3% QoQ and 51% YoY and has been growing at a CQGR 13% in the past 7 quarters. 15 new Fortune 500 clients were added this quarter. Moreover, large deal win rates have also improved and these deals from 2Q are expected to complete transition and begin contributing to revenue, assuming stable conditions.

Valuation and Recommendation - Indian IT Industry has bared the brunt of the ongoing tariff wars the most wherein the valuations of the Companies have bottomed out. Robust uptick in the order book position of these firms are facing delays in ramp up. We believe uncertainty would cool off in the coming months and any signs of revival would see re-rating in the IT stocks. In addition, these firms are ready to grab the immense unfolding of AI opportunities as well. Tech Mahindra is very well placed to be a frontrunner beneficiary in this scenario. Stock is available at a P/E of 19x FY27E EPS which is reasonable and investors can Buy the stock for an upside of 27%.

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176