Buy SBI Life Ltd For Target Rs. 1,950 By Emkay Global Financial Services Ltd

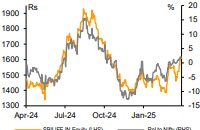

SBI Life reported an impressive performance for Q4FY25/FY25 with VNB margin at 30.5%/27.8%, respectively, clocking in 7.2% VNB growth for FY25. While APE remained largely in-line, the strong margin delivery for Q4FY25 was driven by 1) lower share of ULIPs, 2) increased share of Non-Par and Protection products (led by higher term and rider attachments), and 3) lower share of Group Savings business. Ahead, the management will continue to focus on the agency channel for distribution, and targets ~20-25% Retail APE growth; at the company level, Retail APE growth guidance is 13-14% for FY26. Lower contribution from ULIPs, offset by higher share of Par products, will keep margin stable at ~28%. To bake in the Q4 developments, we increase our APE and VNB margin which results in ~2% increase in FY26-27E VNB. We reiterate BUY and revise up our Mar-26E TP by 5.4% to Rs1,950 (from Rs1,850 earlier), implying 2.0x FY27E P/EV.

Favorable product mix drives strong VNB and margin beat

SBI Life reported FY25 APE at Rs214.2bn (+8.6% YoY) while Q4FY25 APE at Rs54.5bn grew 2.3%, both largely in line with our estimates. However, the favorable product mix led by higher share of non-par and protection amid slow ULIP demand resulted in Q4FY25 VNB margin at 30.5% and FY25 VNB margin at 27.8%, both significantly above our estimates. For FY25, VNB at Rs59.5bn grew 7.2% YoY and was 2.3% above our estimate, whereas Q4FY25 VNB at Rs16.6bn (+9.9% YoY) was ~9% higher than our estimate. EV at Rs702.5bn grew 21% YoY, beating our estimate by 1.1%. Operating RoEV stood at 20.2%. PAT for FY25 at Rs24.1bn grew 27% YoY, at a ~1% beat to our estimates, whereas Q4FY25 PAT at Rs8.1bn was flat YoY and ~3% higher than our estimates.

Faster agency growth to drive ~13-14% retail APE growth; stable margins

Over recent quarters, SBI Life has invested heavily in the agency channel, leading to higher agent activation and increased productivity. Going forward, the management would continue to invest in the agency led by investments in both, agent and branch additions. Against this backdrop, the management remains confident of delivering ~20- 25% Retail APE growth in the agency channel, whereas the banca channel should track single digit Retail APE growth resulting in overall ~13-14% retail APE growth for the company in FY26. The management expects a stable margin outlook, given 1) lower contribution form ULIP to be offset by growth in Par, both tracking similar margins, 2) increase in share of non-par and protection products, 3) investments in the agency channel and opening of new branches leading to higher fixed costs.

Increase VNB estimates; reiterate BUY with revised up TP of Rs1,950

To reflect the Q4 developments, we increase our APE estimates by ~1% and our VNB margin estimates by ~50bps, resulting in ~2% increase in FY26-27E VNB. We introduce FY28 estimates. SBI Life has demonstrated a strong EV compounding over the years, with the EV doubling every four years. Given its strong brand, distribution strength, and low cost, we reiterate BUY on SBI Life, while revising up our Mar-26E TP by 5.4% to Rs1,950 (from Rs1,850 earlier), implying FY27E P/EV of 2.0x.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354