Buy Radico Khaitan Ltd For Target Rs. 3,515 By JM Financial Services Ltd

Exceptional transformation; revenue outperformance to sustain

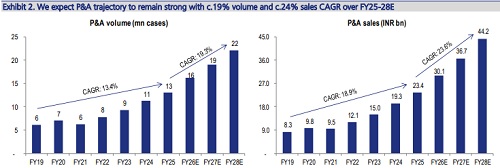

Radico is an impressive story that showcases how one can emerge a winner through agility in identifying white spaces and capitalising on it through disproportionate focus on innovation and well-integrated manufacturing capabilities. Radico has been at the forefront in capturing the premiumisation wave to emerge as one of the fastest-growing players in the P&A segment, outperforming industry as well as large MNC players (UNSP/Pernod Ricard). Radico’s dominance in the fast-growing vodka segment and initial success in the P&A whisky segment provides confidence on sustainability of revenue outperformance (sales CAGR of 18%) vs. peers over FY25-28E. Faster growth in the high-margin P&A segment, stable input costs, UK FTA benefit and scale leverage will drive gains in EBITDA margin. Improving profitability, working capital and lower capex intensity will aid RoCE, drive higher free cash and strengthen the balance sheet. With faster earnings growth (c.36% CAGR over FY25-28E) within the alcoholic beverage space, we expect premium valuations to sustain. Hence, we initiate coverage with a BUY rating and a Sep’26 TP of INR 3,515/share (60x Sep’27E)

* Exceptional transformation crafted by visionary leadership: Innovation, blend, packaging and well-integrated supply chain infrastructure are critical aspects for success in the IMFL industry. A large part of Radico’s success can be attributed to the promoters’ ability to spot opportunities early (for e.g.: premiumisation in vodka, scaling up presence in the luxury whisky segment) and extensive focus on innovation. Impressive execution is visible from a) it being one of the fastest-growing players in the P&A segment, b) dominant market share of 60% in the fast-growing vodka segment and c) initial success in the premium whisky segment.

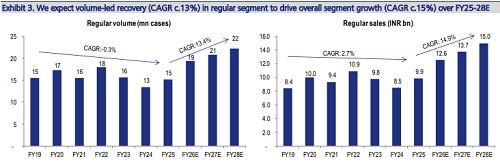

* Enough runway for growth, revenue outperformance to continue: We see Radico’s revenue outperformance continuing, led by – a) Scope for market share gains in the overall IMFL segment and the P&A segment, where its share is still in high single digits, b) favourable regulatory environment in its key markets of UP and AP (c.40% of its IMFL volume), c) high-teens growth in its largest brand ‘Magic Moments’ (c.50% of P&A sales) thereby capitalising on the fast-growing white spirit segment and d) acceleration in the whisky segment (led by recovery in 8 PM premium black, strong traction in After Dark and acceleration in the luxury portfolio) where it is under-indexed (c.38% of Radico’s sales vs. c.60% for industry).

* Improved profitability and working capital to strengthen balance sheet and drive healthy cash generation: After steep margin pressure in FY22/23, Radico’s margin has seen some recovery over FY24/25. We expect the pace of margin expansion to increase led by a) premiumisation – increase in salience of P&A and higher growth in the midpremium/luxury portfolio within P&A, b) improved profitability in the non-IMFL segment, c) benefit of UK FTA, and d) stable input costs. Uptick in margins and better working capital will aid RoCE, which, along with lower capex intensity, will enable healthy FCF generation and ensure debt reduction (net cash by FY27E).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361