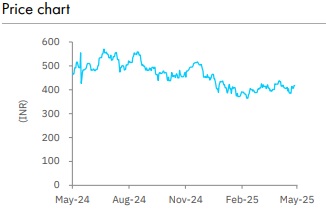

Buy Power Finance Corporation Ltd for Target Rs. 508 by Elara Capitals

Rerating catalysts dissipate

While Power Finance Corporation (PFC IN) concluded FY25 on a steady note, Q4FY25 earnings stood mixed. Healthy 13% YoY loan growth and recoveries from KSK Mahanadi resolution of ~INR 11.9bn bolstered PAT; provisions stood elevated due to NPA recognition of Gensol Engineering with INR 2.6bn exposure and provisions of INR 9bn toward 13 DISCOMS that saw ratings downgrade. Excluding one-off recoveries, NII would have been flat, resulting in a sequential decline in PAT. Given the 10-11% YoY growth outlook, reduced spread expectations at 2.5% (vs 2.6% earlier), and slowing chunky resolutions, POWF's rerating triggers appear to be dissipating. Against this backdrop, we trim our price target to INR 508. We reiterate Buy on attractive valuation.

Recoveries bolster PAT; lackluster EPS CAGR likely: POWF reported a PAT of INR 51.1bn, beating estimates of INR 42.6bn, up 23.0% QoQ and 23.5% YoY, driven by a strong NII of INR 59.1bn, up 25.9% QoQ & 39.5%YoY and robust Other income of INR 12.2bn, up 92.4% QoQ and 61.8% YoY. This was largely attributable to KSK Mahanadi recoveries of INR 12bn. While yields rose 52bp on a sequential basis due to one-offs, exclusive of same, yield declined 39bp QoQ and NIM dipped 17bp QoQ to stabilize at 3.6% for the quarter. Management’s expectations of 2.5% spread underpinned by repayment of 25% of high cost liabilities and 10-11% growth guidance implies a 11% EPS CAGR during FY25-28E.

Growth expectations moderate: AUM at INR 5.4tn, up 7.8% QoQ and 12.8% YoY, was healthy, driven by renewables, up 16.7% QoQ and 34.6% YoY, distribution, up 8.6% QoQ and 14% YoY, and non-power segment, up 52% YoY and 27% QoQ. While generation loans was flat both YoY and QoQ, generation disbursements was strong, up 177.4% QoQ and 147.2% YoY alongside distribution, up 64.6% QoQ & 26.1% YoY; invariably, these could be medium-term growth levers for POWF. Moreover, another INR 390bn sanctions toward the distribution segment and continued renewables traction (levers: GoI impetus, the largest financier) is likely to drive growth. The infrastructure sector is expected to grow gradually. Led by scalability constraints, growth is expected to moderate to 10–11% YoY vs 13-14% for the past three years.

Fraud account recognition, DISCOM provisions offset positives from resolutions: Asset quality improvement with GNPA declining 74bp QoQ due to resolution of KSK Mahanadi of INR 33bn exposure with recovery of full principal and ~INR 11.9bn interest, resulting in a write-back of ~INR 18.2bn. However, full provisioning toward Gensol Engineering of ~INR 2.6bn, with ~INR 0.4bn already recovered and INR 9bn provisions toward 13 downgraded DISCOM projects offset the positives from write-backs. Total stress pool stands at INR 105.2bn, comprising assets, such as TRN Energy (INR 11.4bn, 50% PCR), Shiga Energy (~INR 5.2bn, 31% PCR), Sinnar (~INR 30.0bn, 80% PCR), and India Power Corp (~INR 9.6bn, 50% PCR). We expect a NPA decline to 1.7% by FY27E and 1.5% by FY28E.

Reiterate Buy with a lower TP of INR 508: We raise our estimates by 2.9% for FY26 but trim by 1% for FY27E, which are still on the conservative side. We introduce FY28 estimates.With 10-11% YoY growth expected, POWF is set to lag 12-13% systemic growth for FY26E. Moreover, reduced spread at 2.5% from 2.6%, and slowing chunky resolutions indicate dissipating re-rating catalysts. We lower our SOTP-based TP of INR 508 from INR 569 based on 1.5x (from 1.6x) FY27E P/ABV. We reiterate Buy on 0.7x FY27E PABV adjusted to sub and 3% ROA and 16% RoE during FY27-28E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933