Buy P N Gadgil Jewellers Ltd for the Target Rs. 825 by Motilal Oswal Financial Services Ltd

Robust earnings growth sustains; store expansion on track

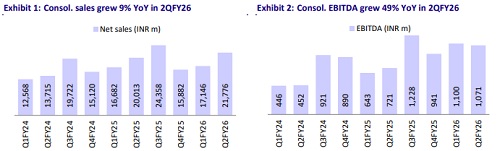

* PN Gadgil Jewellers (PNG) reported a 6% YoY rise in consolidated revenue to INR21.8b (est. INR21.5b) in 2QFY26. Reported growth was impacted by the discontinuation of refinery sales from 3QFY25. Ex-bullion revenue rose 31% YoY, led by 29% growth in retail, 113% in e-commerce, and 106% in franchisee sales. Festive sales during Navratri surged 66% YoY to INR4.3b, supported by an 18% rise in transaction volumes and an average ticket size of INR90,000. In Oct’25, PNG recorded revenue exceeding INR18b, driven by strong festive and wedding season demand, and expects this momentum to sustain in the coming months.

* PNG expanded its network footprint with the addition of eight stores in 2Q, bringing the total to 63 (47 COCO, 16 FOCO), including 4 PNG Litestyle across 32 cities. The company plans to open 13-15 additional stores in 2HFY26, comprising 7-8 PNG stores and 7-8 Lifestyle stores, evenly split between COCO and FOCO formats, taking the total store count to 78-80 by the end of FY26.

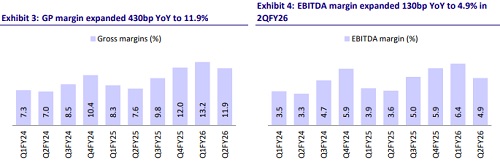

* Gross margin expanded 420bp YoY to 11.9% in 2QFY26 (est. 12%). The improvement in GP margin was supported by a ~50% YoY growth in studded jewelry, which led to a 100bp increase in the studded mix to 9% in 2QFY26. The company continues to focus on enhancing its studded jewelry contribution and expanding its Litestyle format stores, which deliver higher gross margins. The addition of new stores and entry into new states led to higher-than-expected other expenses, resulting in EBITDA margin slightly below estimates. Nevertheless, EBITDA margin expanded 130bp YoY to 4.9% (est. 5.8%). We model an EBITDA margin of 5.5-5.7%% for FY26 and FY27.

* We model a CAGR of 20% in sales, 28% in EBITDA, and 26% in APAT over FY25-28E. With the successful execution of store rollouts, an effective gold hedging policy, and margin expansions, we reiterate our BUY rating on the stock with a TP of INR825 at 30x Sep’27E EPS.

Retail growth at 30%; miss on operating margin due to high opex

* In-line sales growth: PNG’s consolidated sales rose 9% YoY to INR21.8b (est. INR21.5b) in 2QFY26. The company has discontinued HO Bullion accounting from 3QFY25, making the reported numbers not directly comparable and lower than the underlying business performance. Total revenue (ex-bullion) grew 31% YoY. Retail segment (72% of revenue) grew 29% YoY to INR15.7b, reflecting stable store-level operations. E-commerce revenue grew 113% YoY to INR1,435m, now contributing 7% to total revenue. Franchisee operations saw a 106% YoY growth to INR3.4b, contributing 16% to total revenue.

* Miss on operating margins: Gross margin expanded 420bp YoY to 11.9% (est. 12%). Employee expenses rose 51% YoY and other expenses rose 104% YoY. EBITDA margin expanded 130bp YoY to 4.9% (est. 5.8%).

* Strong growth in profitability: EBITDA grew 49% YoY to INR1,071m.

* APAT grew 50% YoY to INR793m. APAT margin came at 3.6% vs 2.6% in 2QFY25.

* In 1HFY26, net sales, EBITDA, and APAT grew 6%, 59%, and 68%.

Key takeaways from the management commentary

* The company delivered a strong festive performance with a 66% YoY increase in Navratri sales, amounting to INR4.3b. In Oct’25, the company recorded revenue of over INR18b, reflecting strong festive and wedding season demand.

* The capital required for opening a new store has increased from INR330-340m last year to INR470-480m currently, primarily due to higher gold prices, including around INR25m of capex per store (each store spanning 3,500-4,000 sq. ft.).

* The company plans to open 13-15 additional stores in 2HFY26, comprising 7-8 PNG stores and 7-8 Lifestyle stores, evenly split between COCO and FOCO formats, taking the total store count to 78-80 by the end of FY26.

* Management highlighted that there is no visible pressure from Lab-Grown Diamonds (LGD) on consumer demand, and the company currently has no plans to expand in that category.

Valuation and view

* We increase our EPS estimates by 6% for FY26 due to an increase in other income and 2% for FY27.

* With a more favorable product mix, operating leverage, and improved sourcing, the company is well-positioned to expand its operating margin. We model an EBITDA margin of 5.5-5.7% for FY26 and FY27. We will monitor the operating cost expansion driven by new store roll-outs.

* The company has strengthened its balance sheet by reducing debt, having repaid INR3b from IPO proceeds. It has also implemented a robust hedging strategy through Gold Metal Loans (GML), achieving 100% hedging coverage. This will lower interest costs and further boost profitability.

* We model a CAGR of 20% in sales and 26% APAT over FY25-28E. With the successful execution of store rollouts, an effective gold hedging policy, and margin expansions, we reiterate our BUY rating on the stock with a TP of INR825 at 30x Sep’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)