Buy Oil and Natural Gas Corporation Ltd for the Target Rs.320 by JM Financial Services Ltd

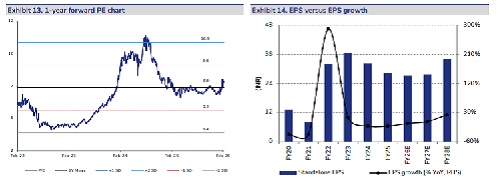

ONGC’s 3QFY26 standalone EBITDA was INR 173bn, 3% above JMFe (and 8% above consensus of INR 160bn) due to: a) lower royalty/cess expense of INR 59.8bn (JMFe of INR 62.1bn); and b) higher revenue from LPG, naphtha and lower sharing of profit petroleum. Crude and gas sales volume was largely in line with JMFe, while crude and gas net realisation was lower. However, dry well write-off was higher at INR 20.5bn (JMFe of INR 12bn) but was largely offset by greater other income and lower taxes. Hence standalone PAT at INR 83.7bn was also 2.6%/10% above JMFe/consensus of INR 81.6bn/INR 76bn. The board approved a second interim dividend of INR 6.25/share in 3QFY26; this takes the total dividend to INR 12.25/share for 9MFY26 (or 59% payout of 9MFY26 standalone EPS of INR 20.9/share) given it paid the first interim dividend of INR 6/share in 2QFY26. We maintain BUY (revised TP of INR 320 – based on 7x FY28 PE versus global peers trading at 8-10x) based on our assumption of: a) Brent at USD 70/bbl versus CMP discounting ~USD 62/bbl of net crude realisation; and b) cumulative output growth of ~6% over FY26-28, driven by Mumbai High, KG DW 98/2 and Western offshore blocks. ONGC is also a robust dividend play (4-5%). At CMP, it trades at 6.7x FY28E consolidated EPS and 0.8x FY28E BV.

? ONGC’s 3QFY26 standalone EBITDA 3% above JMFe (8% above consensus) led by lower royalty/cess, higher revenue from LPG/naphtha and lower sharing of profit petroleum: ONGC’s 3QFY26 standalone EBITDA at INR 173bn was 3% above JMFe (and 8% above consensus of INR 160bn) due to: a) lower royalty/cess expense of INR 59.8bn (JMFe of INR 62.1bn); and b) higher revenue from LPG, naphtha and lower sharing of profit petroleum. Crude and gas sales volume was largely in line with JMFe, while crude and gas net realisation was lower. However, dry well write-off was higher at INR 20.5bn (JMFe of INR 12bn) but was largely offset by higher other income and lower taxes. Hence standalone PAT at INR 83.7bn was also 2.6%/10% above JMFe/consensus of INR 81.6bn/INR 76bn. Standalone 3QFY26 EPS was INR 6.7/share. Consolidated 2QFY26 EBITDA was INR 274bn (INR 276bn in 2QFY26) while consolidated PAT was INR 100bn (EPS of INR 8/share).

? Crude and gas sales volume largely in line with JMFe; but realisation slightly lower: In 3QFY26, domestic crude sales volume was largely in line with JMFe at 4.7mmt (down 2.4% QoQ but up 1.2% YoY) though crude production volume was 0.8% below JMFe at 5.1mmt (down 1.3% QoQ and down 2.2% YoY) as sales as percentage of production was 92% versus JMFe of 91% (~88% historically). Computed net crude realisation, was slightly lower at USD 61.5/bbl (JMFe of USD 62/bbl). Further, gas sales volume was also largely in line with JMFe at 3.95bcm (up 1% QoQ and up 0.6% YoY); gas output was also in line with JMFe at 5.1bcm (up 1.2% QoQ but down 0.3% YoY). Overall gas realisation was slightly lower at USD 7.3/mmbtu (USD 7.6/mmbtu in 2QFY26). Further, management said gas price for production from new wells was USD 8/mmbtu during 3QFY26, and revenue from new well gas was ~INR 17bn and now contributes more than 18% of total gas sales revenue from its portfolio (delivering an additional INR 2.9bn in 3QFY26 and INR 9.4bn in 9MFY26 compared to the APM gas price). Management also shared the following key project updates: a) TSP-1 at Mumbai High Field showing encouraging results; b) KG-98/2 update: All imported mega structures and modules successfully installed at Eastern Offshore; c) Western Offshore Daman Upside Development project nears gas production start; four major infrastructure projects nearing completion.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361