Reduce Indraprastha Gas Ltd for the Target Rs.170 by JM Financial Services Ltd.

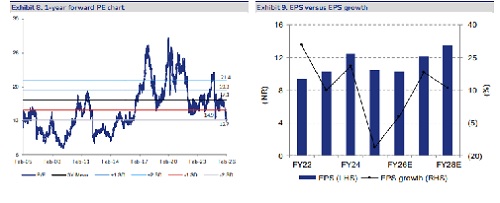

IGL’s 3QFY26 standalone reported EBITDA was INR 4.7bn, slightly lower than JMFe/consensus of INR 4.8bn/INR 4.9bn, as overall sales volume was 1% below JMFe at 9.4mmscmd (up 1.2% QoQ and up only 3.5% YoY). However, EBITDA margin was in line with JMFe at INR 5.4/scm, with higher opex being offset by lower gas cost. Employee cost was slightly higher at INR 0.8bn in 3QFY26 (INR 0.5bn in 2QFY26) due to impact of INR 0.3bn on account of the new labour code. Reported PAT was largely in line with JMFe at INR 3.6bn (a little below consensus of INR 3.7bn) aided by slightly lower taxes. Further, IGL’s share of PAT of CUGL and MNGL was INR 776mn in 3QFY26 (INR 827mn in 2QFY26). The board approved an interim dividend of INR 3.25/share (or 42% payout of 9MFY26 standalone EPS of INR 7.8/share). We maintain REDUCE (revised TP of INR 170) as the ongoing structural reduction in APM gas allocation is likely to continue to pose a risk to IGL’s pricing power in CNG (which constitutes ~70% of its total volume) and, hence, to its volume growth and margin assumption. At CMP, IGL trades at consolidated FY28P/E of 10.8x and consolidated FY28 P/B of 1.7x.

? Overall sales volume was 1% below JMFe at 9.4mmscmd (up 1.2% QoQ and up only 3.5% YoY): Sales volume was 1% below JMFe at 867mmscm or 9.4mmscmd (up 1.2% QoQ and up only 3.5% YoY) as CNG volume was 1% below JMFe at 6.9mmscmd (down 0.5% QoQ and up only 3.4% YoY). Further PNG sales volume was also 1.1% below JMFe at 230mmscm (up 6.5% QoQ and up 3.8% YoY) with industrial/commercial PNG sales volume at 112mmscm (up 5.3% QoQ and up 2.3% YoY) and domestic PNG sales volume at 71mmscm (up 13.5% QoQ and up 7.8% YoY).

? EBITDA margin in line at INR 5.4/scm – higher opex was offset by lower gas cost: Gross margin was higher at INR 11.1/scm in 3QFY26 versus JMFe at INR 10.5/scm (INR 10.3/scm in 2QFY26) led by lower average cost of gas at USD 11.2/mmbtu or INR 35.8/scm versus JMFe of INR 36.3/scm (USD 11.7/mmbtu or INR 36.7/scm in 2QFY26) – this could be partly due to some fall in APM gas cost due to fall in Brent price as highlighted by MGL management. Net sales realisation was largely in line with JMFe at INR 46.9/scm (INR 47/scm in 2QFY26). However, opex was higher at INR 5.6/scm versus JMFe of INR 5.1/scm (INR 5.1/scm in 2QFY26). Hence EBITDA margin was in line with JMFe at INR 5.4/scm (and versus INR 5.2/scm in 2QFY26).

? Maintain REDUCE due to structural risk to pricing power in CNG: We cut FY26-27 EBITDA by 4-5% factoring in slightly lower volume growth and margin, hence TP has been cut to INR 170 (INR 180). We maintain REDUCE as we believe the structural reduction in APM gas allocation by 7-10% p.a. for the CNG business is likely to continue as: a) entire incremental growth of 5-6% p.a. in CNG volume needs to be met via nonAPM gas sources including high-cost LNG given the gradual decline in APM gas output; and b) low-cost APM gas is likely to be gradually replaced by higher cost NWG gas at a rate of ~7.5% p.a. This is likely to continue to pose a risk to the company’s pricing power in CNG (which constitutes ~70% of its total volume) and, hence, its volume growth and margin assumption. At CMP, IGL is trading at consolidated FY28P/E of 10.8x and consolidated FY28 P/B of 1.7x.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

Ltd.jpg)