Buy Petronet LNG Ltd for the Target Rs.360 by JM Financial Services Ltd.

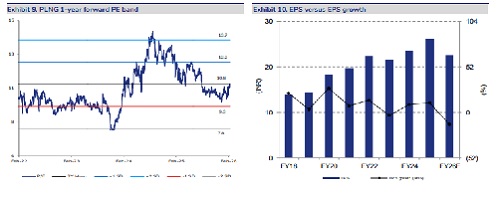

PLNG’s 3QFY26 reported EBITDA of INR 12bn was above JMFe of INR 11.3bn (though in line with consensus of INR 12bn) as: a) regas volume was 1.3% above JMFe and b) implied marketing/inventory gain was above JMFe at ~INR 0.7bn. Further, the company recognised income of INR 0.5bn towards UoP charges for CY25 arising out of lower-than-contracted capacity utilisation by a customer, but that was offset by time-based provision of ~INR 0.8bn made towards UoP dues. However, employee cost was higher at INR 0.9bn in 3QFY26 (INR 0.6bn in 2QFY26) due to impact of INR 0.25bn on account of the new labour code. Hence, PAT was INR 8.5bn, above JMFe/consensus of INR 8.2bn/INR 8.3bn. We reiterate BUY (unchanged TP of INR 360) on valuation grounds, and due to improved visibility of regas volume growth anticipating likely moderation in spot LNG prices over the medium to long term (given 30–40% addition to global LNG supply capacity beginning 2HCY26). At CMP, the stock is trading at an attractive 9.2x FY28E PE (three-year average of 10.8x) and 1.7x FY28E P/B (three-year average of 2.1x).

? 3QFY26 regas volume was 1.3% above JMFe as Dahej utilisation was higher at 94% versus JMFe of 93%: PLNG's overall 3QFY26 volume was 1.3% above JMFe at 233TBTU (up 2.2% QoQ and 2.2% YoY) with Dahej terminal utilisation higher at 94% (JMFe of 93%, and 93% in 2QFY26). Dahej terminal volume was 0.9% above JMFe at 214TBTU (up 1.4% QoQ and 0.5% YoY); of this, long-term volume was lower than JMFe at 91TBTU (95TBTU in 2QFY26) but was offset by short term/spot volume at 4TBTU (nil in 2QFY26) and higher regas service volume of 119TBTU (116TBTU in 2QFY26). Further, Kochi terminal volume was slightly better QoQ at 19TBTU (17TBTU in 2QFY26), implying utilisation of 29%. Dahej and Kochi regas margins were in line with contract. Separately, implied marketing/inventory gain was above JMFe at ~INR 0.7bn in 3QFY26 as per our calculations.

? PLNG increased provision by INR 0.8bn in 3QFY26 towards UoP dues while gross UoP dues fell by INR 0.8bn QoQ to INR 13.1bn at end-3QFY26 (net of provision, it was INR 5.0bn); however, it recognised income of INR 0.5bn towards UoP charges for CY25: PLNG has increased provision by INR 0.8bn in 3QFY26, resulting in net provision rising to INR 8.2bn at end-3QFY26 (versus provision of INR 7.4bn at end-2QFY26) as a matter of prudence based on its time-based accounting policy. Gross UoP dues fell by INR 0.8bn QoQ to INR 13.1bn at end3QFY26 (net of provision, it was INR 5.0bn after adjusting for provision of INR 8.2bn) as one of the customers brought more-than-contracted LNG volume in 3QFY26. Separately, PLNG has obtained bank guarantees (BGs) to secure UoP dues for CY21 and CY22, while it has obtained BGs for CY23 from a majority of customers and is in the process of receiving them from all other customers. Gross UoP dues of INR 13.1bn at end-3QFY26 pertains to CY22 (of INR 6.4bn), CY23 (of INR 5.5bn) and CY24 (of INR 1.2bn). Further, the company highlighted that it recognised income of INR 0.5bn towards UoP charges for CY25 arising out of lower-thancontracted capacity utilisation by a customer

? Reiterate ‘BUY’ on Petronet LNG on valuation grounds and due to improved visibility of regas volume growth: We have cut our FY26-27 EBITDA estimates by 7-15% accounting for muted volume and margins in 9MFY26. However, FY28 EBITDA is largely unchanged; DCF based TP of INR 360 is also unchanged. We maintain BUY on PLNG as a likely normalisation in spot LNG could improve its regas volume growth aided by: i) Dahej terminal capacity expansion (from 17.5mmtpa to 22.5mmtpa by Mar’26); and ii) government/regulator’s initiatives to boost natural gas consumption. Furthermore, we expect no significant diversion of LNG volume from PLNG’s Dahej terminal to other competing terminals as it offers the lowest regas charges and enjoys significant advantage due to its unmatched evacuation capabilities—capacity of 35– 36mmtpa due to its connectivity with five–six natural gas pipelines. Also, it is trading at an attractive 9.2x FY28E PE (three-year average of 10.9x) and 1.7x FY28E P/B (three-year average of 2.1x). However, capital misallocation risk persists amid management’s INR 27bn capex plans w.r.t. the non-core petchem business—although we argue the concern is largely priced in as we value it at only 0.5x investment. Key risks: a) Sustained high spot LNG continuing to impact PLNG’s regas volume growth; b) Sharp cut in Dahej regas margin post-expiry of current contract by Apr’28E—we assume Dahej regas margin stays flat at INR 74/mmbtu from FY29E given peers are likely to charge regas margin significantly above INR 80/mmbtu to justify project viability.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361