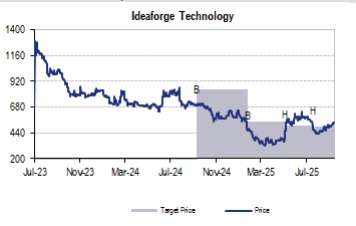

Reduce Ideaforge Technology Ltd For Target Rs. 500 By JM Financial Services Ltd

Focus continues on new product development

We recently met the management of ideaForge Technology Ltd (ideaForge). The management continues its efforts towards new product development and enhancing the capabilities of its existing drones. With a view to diversify into the non-defence segment, the company is focusing on 1) Drone as a Service and b) launching a logistics drone (Yeti - with 100-125km range), which will be the key growth driver for it in the non–defence space in the long run. Short- to medium-term revenue will continue to be driven by the defence segment. The company is L1 in orders worth INR 4bn+. The management expects a few orders under emergency procurement to be concluded in the next few months. We change our rating from Hold in our previous rating system to REDUCE in the new rating system.

* Continued focus on new product development: ideaForge has recently launched a 25km class drone an upgrade of “SWITCH” drone and is also working on a tactical class drone with a 40-50km range. On the logistics drone, the management said YETI’s progress is on track with the 1st prototype ready and expected to be launched in 2 years. Yeti has a range of 100-125km and a payload capacity of 100kg.

* Munitions drop capabilities: ideaForge is currently working on integrating precision munitions drop capabilities in its tactical UAV “ZOLT”, with payload capacity ranging from 300g to 8kg. This is likely to open up a new market for the company.

* Non-defence segment a long-term story: The enterprise business (non-defence segment) will be driven by its run rate business. The management will be focusing on gradually enhancing capabilities for inspection and payload and also expanding the new product portfolio. In the medium term it will be looking at expanding the company’s international footprint for non-defence drones, and expanding Drone as a Service (DaaS) segment. In the long term, Yeti –logistic drones will be the key growth driver for the non-defence segment.

* Other highlights: 1) Emergency procurement cycle is currently ongoing and is expected to be concluded in the next few months. 2) The company has filed for 89 patents, of which 44 have been granted till date. 3)ESOP is close to INR 80mn/annum.

* Order book stands at INR 1,448mn: Order book as of 1QFY26 was INR 1.5bn (vs. INR 542mn YoY). The company is L1 in orders worth INR 4bn+.

* Outlook & valuation: Though the company’s long-term prospects are healthy due to its core strengths, namely, technical knowhow, new technology and product development capability, its near-time performance will continue to be impacted due to 1) lower opening order book, 2) delayed ordering activity and 3) delayed finalisation of L1 orders (INR 4bn+). We change our rating from Hold in our previous rating system to REDUCE in the new rating system with TP of INR 500 (unchanged), valuing it at PE of 35x FY27E EPS.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361