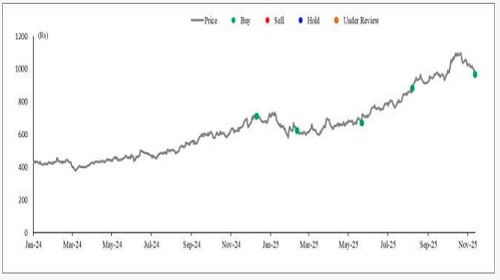

Buy Fortis Healthcare Ltd For Target Rs. 1,070 - Axis Securities Ltd

Strong Quarter with Margin Expansion

Est. Vs. Actual for Q2FY26: Revenue – INLINE; EBITDA Margin – BEAT; PAT – BEAT

Changes in Estimates Post Q2FY26

FY26E/FY27E: Revenue: 0.3%/-0.2%; EBITDA Abs: 6.2%/2.0%; PAT: 2.4%/1.6%

Recommendation Rationale

* Strong Revenue Growth Driven by Hospitals Segment: The Fortis Hospitals segment posted revenue of Rs 2,331 Cr, up 17.3% YoY and 7.6% QoQ, driven by the Hospital segment, which has reported 19.3% YoY growth, along with moderate growth in the Diagnostic Arm.

* Stable ARPOB and Occupancy: ARPOB stood at Rs 68,800, marking a 5.9% YoY increase, while occupancy rose to 71% (up 100 bps QoQ), supported by a 13% YoY growth in occupied bed days. EBITDA margin expanded to 23.9%, up 200 bps YoY and 120 bps QoQ.

* Agilus Diagnostics: Agilus reported revenue of Rs 358 Cr, up 7% YoY, with EBITDA at Rs 104 Cr, translating to a margin of 29.1%, a 510 bps improvement YoY.

Sector Outlook: Positive

Company Outlook & Guidance Management expects H2FY26 revenue growth to remain in line with H1 levels, supported by sustained volume expansion and continued ARPOB improvement. ARPOB is projected to rise 5–6% in FY26, led by a richer speciality mix in oncology and complex procedures such as robotic surgeries. Occupancy is likely to stay above 70% as new units like Greater Noida and Jalandhar ramp up. The company now expects FY26 EBITDA margins at 23– 24%, aided by the strong Q2 margin and remains focused on achieving the long-term 25% margin target. For Agilus, volume growth is expected to move into early double digits over the next 6–8 quarters, as the base normalises post the exit from the low-ticket business and overall demand momentum sustains.

Current Valuation: EV/EBITDA 29x for H1FY28E EBITDA (Earlier Valuation: 28x H1FY28E)

Current TP: Rs 1,070/share (Earlier TP: Rs 1,000/share)

Recommendation: BUY

Financial Performance

Fortis Healthcare reported revenue of Rs 2,331 Cr, which is in line with our expectations and supported by higher ARPOB and stabilised occupancy levels. ARPOB stood at Rs 68,800, up 5.9% YoY, while occupancy was stable at 71%, driven by a 13% YoY growth in occupied bed days. The Hospital segment’s reported revenue and EBITDA margins stood at Rs 1,974 Cr and 22.9% with 27.3% EBITDA growth over the year. The rebranded Agilus Diagnostics reported revenue of Rs 358 Cr, growth of 7% YoY, and an EBITDA of Rs 104 Cr, reflecting a 29.1% margin, up 510 bps YoY. The margin improvement reflects operational recovery and efficiency gains as the business continues to scale postrebranding.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633