Buy Metro Brands Ltd For Target Rs. 1,270 by Centrum Broking Ltd

In-Line Result; Healthy Topline & Margin Performance

METRO Q1 result was in-line with our estimates. The company witnessed third consecutive quarter of high single digit/DD growth. However, the growth is lower than long to mid term revenue guidance of 15-18% which management attributes to lumpiness in business due to COVID. The management aims to drive topline growth on the back of (i) healthy SSSG (mid to high single digit), (ii) store addition and (iii) addition of new formats. Positively, the company has picked up store addition for Walkway (huge opportunity in value footwear), Footlocker & Fila (supply chain disruptions with BIS implementation are waning) as well as introduced new format – Clarks. Therefore, the company along with core brands (Metro+Mochi+Crocs) has a healthy portfolio of formats. The company’s focus on profitability with guidance of 30%+ EBITDA Margins and mid teens PAT margins is maintained. The company has delivered better than peers growth in terms revenue growth and consistent profitability and we believe the outperformance will continues, therefore we assign a BUY rating on the stock. Store Expansion Led Growth

Consol revenue grew by 9.1%YoY driven by store network expansion by ~8.7%YoY. The business was positively impacted by increased demand from higher no of marriage dates while eid pre-ponement, early monsoon and geopolitical tension partly offset demand momentum. The Company added 20 stores (net) during the quarter taking the total store count to 928 across 206 cities. The company entered 1 new cities in the quarter. The company added 5/9/2/4 stores for Metro/Mochi/Crocs/Walkway respectively. The company saw ~200-300bps impact on growth due to preponement of EID. The company has maintained its long terms revenue CAGR guidance of 15-18% driven by (i) SSSG, (ii) introduction of new formats/ banner and (iii) new store addition.

Healthy Margins; Maintains Margin Guidance

Gross margins contracted by 16bps YoY to 59.3%. Higher other expenses (+58bps YoY as % of sales) led to EBITDA margin contraction to be sharper than gross margin contraction. EBITDA Margins contracted by 45bps YoY to 30.9%. PBT grew by 5.7%YoY while PAT grew by 7.1%YoY due to lower tax rate of 24.6% (vs 25.1% in base quarter). The company has maintained its EBITDA/ PAT margin guidance at 30%+/mid teens.

Valuation &Risk

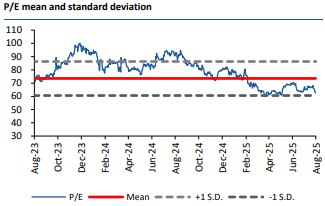

Metro Brands has corrected by ~18% over the last one year due to moderation in growth rates and lower store addition. The company has seen growth pick-up with DD/High single digit growth over the last three quarters; however it is lower than long/medium term guidance of 15-18%. We estimate revenue/PAT CAGR of 14.6%/24.6% over FY25- 28E. We assign BUY rating on the stock. We roll forward our EPS estimates to Sept’27 of Rs23.1 resulting in target price of Rs1,270 based on target PE multiple of 55x.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331