Buy KFIN Technologies Ltd For Target Rs. 1,280 By Elara Capital

Q3 ahead of expectations

KFIN Technologies (KFINTECH IN) delivered a robust Q3FY26, marked by better -than - expected revenue momentum. Consolidated revenue from operations grew 27.9% YoY to INR 3,709mn. The domestic mutual fund (MF) segment grew ~8% YoY, with AAUM increasing ~18% YoY and ~5% QoQ. MF segment yields declined to 3.36bps (34.6bps in Q2FY26), primarily due to a shift in the asset mix toward ETFs. The Issuer Solutions segment reported strong revenue growth of ~22% YoY, supported by folio growth to 168mn from 156mn in Q3FY25. In ternational and Other Investor Solutions revenue grew ~143% YoY, largely driven by the integration of Ascent Fund Services (excluding Ascent, growth stood at ~17%). Overall, EBITDA increased 16.1% YoY to INR 1,516mn, with margins of 40.9% including Ascent and 46.3% on a standalone basis. PAT rose 2.0% YoY to INR 920mn (margin: 24.8%), impacted by a one -time charge of INR 86mn related to changes in the Labor Code . Key monitorables going forward include: 1) EBITDA margin improvement in Ascent , 2) AUM growth a nd yield trends in the domestic MF business, and 3) folio growth in the Issuer Solutions segment . We maintain BUY.

Ascent remains a global growth catalyst: Ascent contributed meaningfully in its first full quarter of consolidation, lifting consolidated revenue growth to 27.9% YoY ( versus 11.4% exAscent) and driving the International & Other Investor Solutions segment up 143% YoY. Ascent delivered 27.4% YoY revenue growth, added 47 new funds, expanded the international client base to 428, scaled AUM to US D 40.9bn, and improved EBITDA margin to ~4.3% in Q3FY26 from breakeven in the prior quarter. Key wins included selection of its flagship platform by one of the world’s largest multinational ba nks, a maiden pension administration mandate from a leading bank in The Philippine s, digital solutions deals in Malaysia, and a full -suite digital asset fund administration mandate in Bahrain. With a three -year roadmap to align margins with KFINTECH via operating leverage, cost synergies, and cross -selling, management expects reduced reliance on domestic mutual fund revenues to below 50% over time, supported by rising AUM across Southeast Asia and private markets.

Issuer Solutions scalable, annuity-led growth engine: Issuer Solutions is poised to drive meaningful incremental revenue through annuity -based folio growth, higher corporate action activity, client expansion, and cross -selling of value -added tech solutions. With nearly 10,000 clients (over 9,000 unlisted corp orates) and 168 mn folios under management, the business enjoys sticky, recurring per -folio revenue, with unlisted clients generating higher yields as they move toward IPOs or listings. We factor in consolidated revenue CAGR of ~19.3% over FY26 -28E, with EBITDA growing faster at ~22% CAGR over the same period.

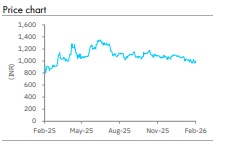

Maintain BUY; TP unchanged at INR 1,280: We maintain BUY, given the accelerating diversification and scaling of high -margin non -MF segments, with multi -year compounding potential from international business. W e have moderately upgraded our revenue estimates by 2.9%/3.1%/2.9% for FY26E/27E/28E respectively, and our EBITDA margin expectations remain broadly unchanged . We maintain our TP at INR 1,280 as we roll forward by a quarter and revise our estimates. Our TP implies 40 x Dec -27E EPS .

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)

.jpg)