Buy JSW Steel Ltd for the Target Rs. 1,350 by Motilal Oswal Financial Services Ltd

In-line 2Q; newly added capacity to drive growth

* JSW Steel (JSTL) posted a consolidated revenue of INR451.5b (+14% YoY and +5% QoQ), which was broadly in line with our estimate of INR431b.

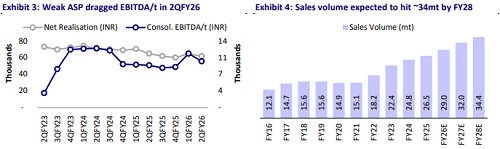

* EBITDA stood at INR71.2b (+31% YoY), supported by strong volume growth and lower input costs; however, it declined by 6% QoQ over muted steel prices sequentially.

* EBITDA/t for the quarter stood at INR9,693/t and was up 9% YoY. It dipped 14% QoQ (vs. our est. of INR8,900/t). APAT stood at INR16.2b (+152% YoY and -26% QoQ vs. our est. INR15.5b) during the quarter.

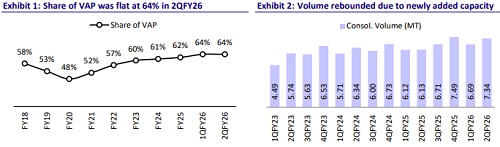

* Consolidated crude steel production stood at 7.9mt (+17% YoY/+9% QoQ), led by the resumption of the Dolvi plant after the planned maintenance shutdown in 1QFY26 and the ramp-up of the JVML and BPSL expansions.

* Steel sales volumes came in at 7.34mt (+20% YoY and +10% QoQ), while the ASP for the quarter stood at INR61,500/t (-5% YoY and QoQ).

* Domestic sales stood at 6.33mt (up 14% YoY and 6% QoQ). Exports rose 89% YoY and 56% QoQ, contributing 10% to the sales from the Indian operations in 2QFY26. Retail sales volumes grew 26% YoY and 13% QoQ.

* Net debt/EBITDA stood at 2.97x in 2QFY26 vs 3.2x in 1QFY26.

* For 1HFY26, JSTL’s revenue/EBITDA/PAT grew 7%/34%/156% YoY, led by better volume and lower costs.

Highlights from the management commentary

* Volumes are expected to improve in 2HFY26, driven by stronger demand led by higher government and private capex and festive demand.

* Management also expects EBITDA/t to improve in 2HFY26, supported by better NSR and subdued input costs.

* Blended coking coal costs were down by ~USD6/t in 2QFY26 (in line). The energy costs were lower both in terms of specific consumption and price due to a higher renewable energy share. Management foresees a rise in coking cost by USD3-5/t in 3QFY26.

* Domestic steel prices currently trade at a discount to import parity, but normalization is expected as demand strengthens and imports moderate. In 2QFY26, blended steel prices softened, led by global uncertainties, cheaper imports into India, and the seasonal monsoon affecting infrastructure and construction demand.

* Iron ore prices are expected to decline in 3QFY26, aided by strong domestic supply and lower bids from Odisha Mining Corporation tenders.

* JSTL has limited exposure to Europe (<3% of volumes); hence, the implementation of CBAM will have a limited impact.

Valuation and view

* JSTL reported a decent performance in 2QFY26, supported by volume growth, offsetting the muted steel prices. We believe JSTL is well-placed with new capacities coming on-stream, strong domestic demand, and a rising share of value-added proportion in the sales mix. Its focus on increasing the captive share of iron ore and improving coal linkages will support earnings.

* Going forward, we estimate double-digit revenue growth in FY26/FY27, driven by the ramp-up of new capacity and price recovery. Further, as input costs are expected to remain soft, we believe EBITDA margin will rebound to 18-19% in FY26/FY27 (~INR12,000/t in FY26E and ~INR13,500/t in FY27E) on account of domestic steel price recovery led by safeguard duty.

* Strong margins will enable JSTL to generate a strong CFO to fund the expansion plans of INR690b (annual INR200b each) over FY26-29E. JSTL’s net debt/EBITDA stood at 2.97x as of 2QFY26, which we expect to decline further by FY28, supported by robust operating performance.

* At CMP, JSTL trades at 8.6x FY27E EV/EBITDA, and we broadly retain our FY26/FY27 earnings estimates. We reiterate our BUY rating on the stock with a TP of INR1,350 (premised on 9x EV/EBITDA on Sep’27 estimate).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412