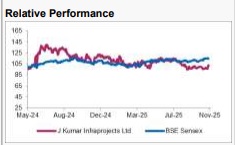

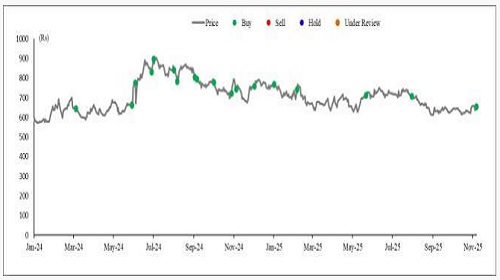

Buy J Kumar Infraprojects Ltd For Target Rs. 775 - Axis Securities Ltd

Miss Estimates On Slower Execution; Retain BUY

Est. Vs. Actual for Q2FY26: Revenue– MISS; EBITDA Margin– INLINE; PAT– MISS

Change in Estimates post Q2FY26 (Abs.)

FY26E/FY27E: Revenue: -6%/-8%; EBITDA: -6%/-8%; PAT: -6%/-11%

Recommendation Rationale

* Strong Order Book to Drive Revenue Growth: As of 30th Sep’25, the company’s order book stood at Rs 20,160 Cr. It is L1 for a project worth Rs 1,200 Cr related to a convention centre in Lucknow. The strong order book offers healthy revenue visibility for the next 3-4 years. We expect the company to deliver a revenue CAGR of 13% over FY25-27E.

* Strong Bidding Pipeline to Support Future Growth: The company has a strong bidding pipeline of Rs 20,000–25,000 Cr for H2FY26, comprising flyovers, elevated corridors, and water projects. With this pipeline, the company aims to secure project wins in the range of Rs 5,000–6,000 Cr in FY26.

* EBITDA Margin Expansion Expected: The company expects EBITDA margins to improve in FY26, driven by efficient project execution and incremental order inflows. Management has guided for margins in the range of 14%–15% in FY26 and 15%–16% in FY27.

Sector Outlook: Positive

Company Outlook & Guidance: The company has revised its revenue guidance to the range of Rs 6,200–6,300 Cr, with EBITDA margins expected to remain in the range of 14%–15% in FY26.

Current Valuation: 11.5x FY27 EPS (Earlier Valuation: 12x FY26E EPS)

Current TP: Rs 775 /share (Earlier TP: Rs 905/share)

Recommendation: We maintain our BUY recommendation on the stock

Financial Performance

J Kumar Infraprojects Ltd. (JKIL) reported a steady performance in Q2FY26. The company posted revenue of Rs 1,337 Cr (up 3% YoY), EBITDA of Rs 194 Cr (up 3% YoY), and PAT of Rs 92 Cr (up 2% YoY). EBITDA margins stood at 14.5% in Q2FY26 (vs. the estimate of 14.4%) compared to 14.6% in Q2FY25.

Revenue mix indicates 32% contribution from underground metro, 16% from elevated metro, 10% from elevated corridors/flyovers, 13% from roads and road tunnels, 4% from water, and 25% from civil and other projects. Geographically, 64% of revenue was derived from Maharashtra, 14% from NCR, 3% from UP, 14% from Tamil Nadu, 4% from Gujarat, and 1% from Karnataka.

Outlook: JKIL remains one of the most established EPC contractors, well-positioned to benefit from its strong order book, robust execution capabilities, and sound financial profile. We estimate Revenue/EBITDA/APAT CAGR of 13%/14%/14%, respectively, over FY25–FY27E, driven by its diversified order book, healthy bidding pipeline, emerging opportunities in the infrastructure space, and consistent execution track record. However, the slower pace of new order inflows remains a concern, leading to a downward revision in our estimates.

Valuation & Recommendation

Currently, the stock is trading at 11x and 9x FY26E and FY27E EPS, respectively. We maintain our BUY rating on the stock and value the company’s business at 11.5x FY27E EPS to arrive at a target price of Rs 775/share, implying an upside potential of 25% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633