Buy Ipca Laboratories Ltd for the Target Rs. 1,720 by Motilal Oswal Financial Services Ltd

Branded generics drive earnings

Work-in-progress across DF/Unichem/branded exports

? Ipca Laboratories (IPCA) reported in-line revenue and better-than-expected EBITDA/PAT (10%/12% beat) in 3QFY26, aided by product mix, favorable currency and a lower tax rate.

? IPCA remains on a robust growth path in domestic formulation (DF) segment, as the company not only delivered healthy double-digit YoY growth but also outperformed the industry.

? The generics exports segment has witnessed steady sales for the past three quarters, with higher volume off-take and currency benefits. ? API business remains volatile, subject to customer requirements. In addition to external supply, IPCA is working on backward integration with Unichem to improve operational efficiency.

? Unichem reported a modest ~2% YoY revenue decline in 3QFY26, primarily due to a temporary US market share loss in select molecules; the US contributes ~two-thirds of its total revenue.

? Unichem’s growth trajectory should improve with recovery in lost US share, scaling of Ipca’s pipeline through its platform, and 4-5 planned US product launches over the next 12-24 months, alongside ongoing European filings.

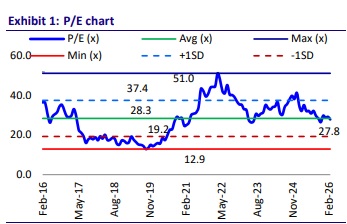

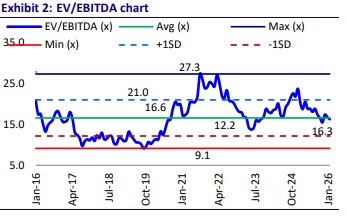

? We raise our earnings estimate for FY26, factoring in improved execution in branded generics in India as well as export markets. We value IPCA at 28x 12M forward earnings to arrive at a TP of INR1,720.

? IPCA is working on initiatives to sustain earnings growth momentum, such as a) superior execution in DF and branded export markets, b) enhancing business prospects in US generics, c) synergy benefits from Unichem. Accordingly, we estimate a CAGR of 13%/17%/16% in revenue/EBITDA/PAT over FY26-28. Maintain BUY.

Healthy margin gains offset modest revenue growth

? 3QFY26 sales grew 6.6% YoY to INR23.9b (our est: INR24.1b).

? Gross margin (GM) expanded 230bp YoY to 72.5%. As a result, EBITDA margin expanded 170bp YoY to 22.3% (our est: 20.1%).

? EBITDA grew 15% YoY to INR5.3b (our est: INR4.8b). ? 3Q had an exceptional gain of INR177m related to sale of land and building.

? Adj. for the same, PAT grew 26% YoY to INR3.1b (our est.: INR2.8b).

? For 9MFY26, IPCA revenue/EBITDA/PAT grew 8%/15%/30% to INR73b/ INR15b/INR9b.

? For Unichem, revenue/EBITDA fell 2%/44% to INR5.2b/INR478m in 3Q, while EBITDA margin declined 680bp to 9.2%.

? There was a one-time gain of INR2.7b on the sale of land and building (registered office). Adjusted for the same, Unichem PAT declined 67% YoY to INR189m in 3Q.

? For 9MFY26, Unichem revenue increased by 13% YoY, while EBITDA/PAT declined by 27%/38% YoY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

Ltd.jpg)