Buy Infosys Ltd for the Target Rs. 1,780 By Prabhudas Liladhar Capital Ltd

Strong H1 performance but slower H2 to follow

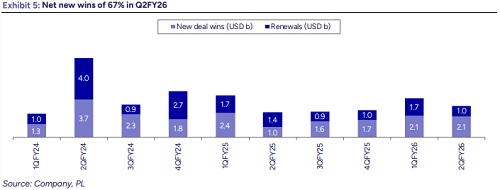

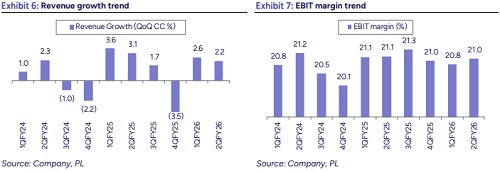

The revenue growth performance (+2.2% CC QoQ) was above our estimates (+1.8% QoQ CC), attributed to broad-based growth in verticals and geographies. The inorganic contribution was 20bps QoQ CC. Despite the quarterly outperformance the underlying demand continues to be on a similar line of Q1. The short-burst discretionary deals continue to see a pullback, while large deals are prioritized for cost reduction, vendor consolidation and AI infusion to derive better productivity. We believe, unless the AI deployment reprioritized to growth initiatives, keeping the topline stable and predictable would be challenging. Although the large deal TCV was strong in Q2, the usual furloughs and holidays impact would weigh on the topline in H2. With the revised guidance, the ask-rate for the rest of the year translates to -0.3 to - 1.5% CQGR. We are passing on Q2 revenue beat, while we expect the large deal (announced off late) ramp up to partially support the topline in H2. On margins, slight escalation on subcon and lower utilization pressurized margins in Q2, although project Maximus and currency tailwind offset the drag. H2 is expected to be weak and over-utilization of levers would provide lesser headroom for margin improvement. We are baking in revenue growth of 2.5%/5.8%/6.7% CC YoY and margin improvement of 10/50bps/40bps YoY in FY26E/FY27E/FY28E, respectively. We retain our “BUY” rating with TP of Rs. 1,780 (earlier Rs. 1,760).

Revenue: INFO reported another quarter of strong execution with revenue of USD 5.07 bn, up 2.2% QoQ CC (20 bps inorganic contribution) above our & consensus estimate of 1.8% CC growth. Growth was largely broad based across geographies & verticals (only retail declined sequentially).

Operating Margin: EBIT margin during the quarter improved by 20 bps QoQ to 21.0%, which was slightly below our and consensus estimates of 21.2% and 21.3%, respectively, despite revenue beat. The margin walk for the quarter comprised +60 bps from currency benefits and +30 bps from Project Maximus, partly offset by – 70 bps due to higher subcontracting costs, lower utilization, and increased postsales customer support expenses.

Guidance: Infosys narrowed its revenue growth guidance to 2–3% YoY in CC (earlier 1–3%), while retaining its operating margin guidance at 20–22%.

Valuations and outlook: We estimate USD revenues/earnings CAGR of 5.5%/9.7% over FY25-FY28E. The stock is currently trading at 19x FY27E, we are assigning P/E of 22x to LTM Sep. 27E earnings with a target price of Rs. 1,780 while maintaining our BUY rating on the stock.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271