Buy Indian Hotels Company Ltd for the Target Rs.845 by JM Financial Services Ltd.

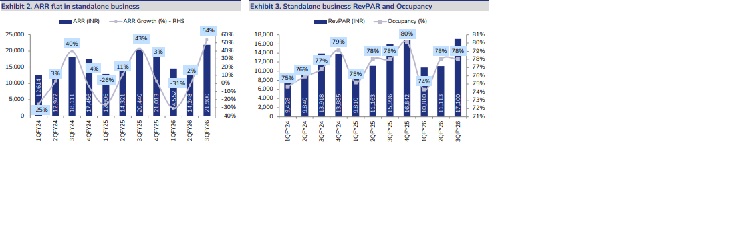

Indian Hotels’ (IHCL) earnings print was in line, with consolidated revenue growing 12% YoY to INR 28.4bn (JMFe: INR 28.4bn) and EBITDA at INR 10.8bn (up 12% YoY), marginally lower (0.8%) than our estimates. Standalone business revenue grew 10% YoY to INR 16.1bn, led by 13%/11% YoY growth in F&B revenue and management fees respectively. Standalone RevPAR growth was tepid at 7% YoY. Standalone EBITDA of INR 7.6bn contributed c.70% of consolidated earnings and grew at 11% YoY. Consolidated same-store RevPAR grew 9% YoY to c. INR 13,800, with 3QFY26 occupancy of 78% (+120 bps YoY) while ARR increased 7% YoY to c. INR 17,700. IHCL remains confident of achieving its guidance of double-digit revenue growth for the full year. We expect the company to report 13%/15% CAGR in Revenue/EBITDA over FY25-28E aided by 7% CAGR in ARR and gradual improvement in occupancy. We maintain BUY rating with a Mar’27 target price of INR 845, valuing the company at 28x Mar’28 EBITDA.

? In-line performance led by F&B segment: IHCL reported consolidated EBITDA of INR 10.8bn (+12% YoY; +89% QoQ) on revenue of INR 28.4bn (+12% YoY; +39% QoQ), yielding core margin of 38%. The growth was aided by (1) new hotel openings, (2) 3QFY26 consolidated same-store RevPAR growth of 9% and (3) 15% growth in management fees. Revenue growth was led by the markets of Rajasthan (+25% YoY), Kolkata (+13%) and Goa (+10%). International operations also contributed to growth, as the US business posted 14% revenue growth and 74% increase in EBITDA in 9MFY26. Standalone RevPAR growth was tepid at 7% YoY. Consolidated same-store RevPAR grew 9% YoY to c. INR 13,800, with 3QFY26 occupancy of 78% (+120 bps YoY) while ARR increased 7% YoY to c. INR 17,700. Management highlighted that London was a key drag in the current quarter due to extensive renovations across banqueting facilities, lobby lounges and rooms; however, most inventory is expected to return between late Feb’26 and early Mar’26.

? New businesses maintain the growth trajectory: In 3QFY26, new businesses comprising Ginger, Qmin, amã Stays & Trails and Tree of Life reported an enterprise revenue of INR 3.2bn, up 39%, and consolidated revenue of INR 2.2bn, up 31%. Enterprise revenue of Ginger stood at INR 2.3bn with a strong EBITDAR margin of 47%. The Air & Institutional Catering business segment (TajSATS) clocked a revenue of INR 3.2bn in 3QFY26 (up 18% YoY), while EBITDA stood at INR 0.8bn with margin coming in at 26%. Management fee income grew by 15% YoY during the quarter to INR 2.0bn led by new openings. Qmin has grown to 110 outlets across multiple formats, amã Stays & Trails has reached a portfolio of 351 bungalows with 176 in pipeline and Tree of Life is at a 27 resorts portfolio with 9 in pipeline.

? Asset-light expansion: IHCL continued its growth momentum in YTD FY26 with 239 signings to increase its portfolio to 617 hotels and opened and onboarded 120 hotels, led by strategic partnerships and acquisitions. It expanded its portfolio with the acquisition of a controlling stake in Atmantan, an integrated wellness brand, and entered into definitive agreements to acquire 51% stake in Brij, a boutique experiential leisure offering, and scaled the Ginger brand with 51% acquisition in ANK & Pride Hospitality. IHCL has 30,200 keys under development, nearly equal to its operational base, with 94% of the pipeline on a capital-light model. The total portfolio now spans 15 countries and 300+ locations, providing strong multi-year earnings visibility.

? Valuation and view: We expect the company to report 13%/15% CAGR in Revenue/EBITDA over FY25-28E aided by 7% CAGR in ARR and gradual improvement in occupancy. We maintain BUY rating with a Mar’27 target price of INR 845, valuing the company at 28x Mar’28 EBITDA.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361