Buy Hindware Home Innovation Ltd for the Target Rs. 375 by Choice Institutional Equities

Business Overview:

HINDWARE is a prominent player in the Building Materials sector, specialising in Sanitaryware, Faucetware, Pipes and also has a presence in the Consumer Appliances segment. Bathware/Pipes/Consumer Appliances segments respectively contributed 64% / 22% /14% of revenue in Q1FY26. In March 2025, HINDWARE announced a turnaround plan and demerger of its loss-making Consumer Appliance business. Also, it appointed a new CEO to turnaround its Bathware business, where the company was not performing up to its full potential. Strategic and tactical initiatives are underway to strengthen the Pipes business too. Investment case for HINDWARE hinges upon a turnaround of the Bathware and Consumer Appliances segments and improvement in the Pipes business.

What is the turnround plan for its Bathware segment?

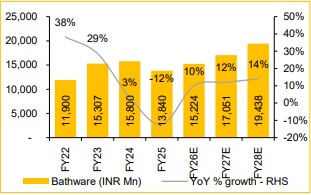

HINDWARE holds a prominent position in the Bathware segment, supported by strong brand awareness and recall. However, it has been losing its market share over the last several quarters. In March 2025, the company appointed Mr. Nirupam Sahay as the CEO to turn around the business. Mr. Sahay has embarked on a new go-to-market strategy, which focuses on premiumisation, new product launches and strong engagement with weighted dealers. These initiatives have already started to deliver good results, as the segment reported high double-digit growth in Q1. New products contributed ~33% of Q1 sales, while institutional sales accounted for 25% of overall EBITDA . Management is confident of growing significantly faster than the market’s low single-digit pace, regaining HINDWARE’s market share, and targeting mid-teens EBITDA Margin in FY26E and high-teens by FY27E.

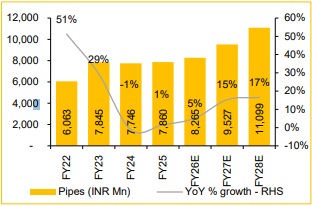

What initiatives HINDWARE’s is taking to improve its Pipes business? HINDWARE’s Pipes business has a strong brand recall and good presence in key states, such as Telangana, Andhra Pradesh, Maharashtra and Gujarat. To support future growth and meet rising demand, the company has planned a new capex of 12.5KT at Roorkee. Additionally, HINDWARE is also broadening its product portfolio with new offering, such as foam core pipes for underground drainage, double-wall corrugated (DWC) pipes and polypropylene (PPR) random plumbing pipes and fittings, which command higher margins. Backed by these initiatives, the management is confident of achieving 10% volume growth with 9.5% to 10% EBITDA margin.

What’s the plan for turning around appliances business?

HINDWARE’s management has announced the demerger of Consumer Appliances business, a value unlocking event for its shareholders. The scheme has to undergo regulatory approvals, which might take up to 6–9 months from now. Meanwhile, the management is also focusing on discontinuing unprofitable product lines, such as ceiling and other fans, air purifiers, furniture fittings and water purifiers. The plan is to strengthen its position in specific, high-demand and profitable categories, such as kitchen hobs and chimneys.

Valuation:

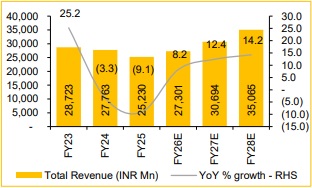

We now value HINDWARE on 1 year forward (blend of FY27E-FY28E) EV/EBITDA multiple of 9x which we believe is conservative given significant turnaround expected in ROCE from 1.4% in FY25 to 17.0% by FY28E. We did a sanity check of our EV/EBITDA TP using implied P/BV, and P/E multiples. On our TP of INR 375, FY27E implied PB/PE multiples are 3.4x/31x.

Key Risks:

* Order Book: High dependence on a few large orders makes the order book vulnerable to delays or cancellations.

* Capex – Large capex burden poses a risk if new plants fail to ramp up as planned.

* Regulatory Risk – Regulatory changes may disrupt operations or lead to compliance costs.

Piping segment to rebound over FY25-28E

Bathware segment to grow by 12% CAGR over FY25-FY28E???????

Total revenue to grow by 12% CAGR over FY25-FY28E???????

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)