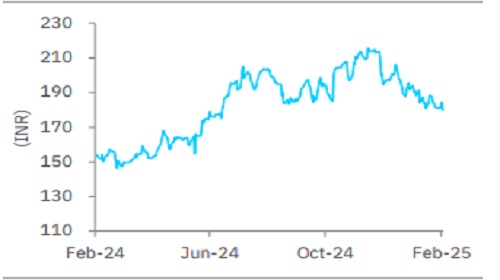

Buy Federal Bank Ltd For Target Rs. 220 By Elara Capital Ltd

Balancing Transition, Strategy & Execution key

Federal Bank (FB IN) hosted an analyst meet recently, which outlined a strategy blueprint under the aegis of new MD & CEO KVS Manian. While we found the blueprint to be detailed, it seemed to lag on quantification to benchmark the progress. The intent, team and resources seem to be in place, but execution needs a watch, especially as anecdotally these transitions have been difficult. The roadmap suggests the bank is likely to undertake the transition on both sides of the balance sheet (loan and deposit construct), which we believe takes time and may have near-term dislocation, even as it may lead to longer-term gains. Also, the requirement of upfronted cost allocation will have a near-term impact. Not to mention, sectoral headwinds on NIM and variables at play on deposits would add to transition variabilities and may feed into near-term soft core performance. Amid the transition, sectoral headwinds and peer valuation (few frontline private banks are trading at similar and/or lower levels), near-term outperformance is likely to be limited with longer-term benefits. We reiterate Buy with a TP of INR 220 based on 1.3x September 2026E P/BV.

Making the right moves but the road to success is lined with execution:

The bank outlined a strategic blueprint with underlying aspirations of: 1) becoming the Top 5 private banks, 2) building a universal bank by augmenting other value added service, and 3) building a national franchise by strengthening brand presence & augmenting scale of operations. The bank aims to focus on 1) NIM (this will need balance sheet changes), 2) fee income, and 3) offering other services (open to inorganic routes). The intent seems right, but execution will be crucial, which entails challenges.

Price chart

Source: Bloomberg

Undertaking transition on 12 key themes:

The bank has outlined 12 key themes detailing crucial success factors. Theme 1: NIM improvement: driven by focus on CASA with heavy lifting by CA focus while scaling up medium-yield assets (not in favor of dumbbell strategy), 2) Theme 2: expanding product portfolio: used vehicle, micro LAP and tractor finance, 3) Theme 3: Fee enhancement: tougher one per management, 4) Theme 4: branch strategy for scalable growth: aims to add 400-450 branches until FY28 (1,550 currently), 5) Theme 5: branch transformation: focus on efficiency, 6) Theme 6: brand transformation, 7) Theme 7: digital augmentation, 8) Theme 8: renewed digital distribution strategy, 9) Theme 9: people & culture, 10) Theme 10: cost optimization – leverage Fedserv, 11) Theme 11: strengthening assurance functions, and l2) Theme 12: evolution towards a universal bank open to inorganic opportunities.

Reiterate Buy with a TP of INR 220:

FB has been delivering steady earnings in an otherwise difficult operating environment, but the current transition will lead to variabilities in the near term even as longer-term benefits will accrue. The bank has strengthened its underlying in the past few years, which will help it deliver a ROA and a ROE of 1.2% and 12-13%, respectively, by FY27E. It seems to be focused on making the right moves but transition will have its challenges, feeding into near-term vulnerabilities. We retain Buy with a TP of INR 220 on 1.3x September 2026E P/BV.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)