Buy DOMS Industries (DOMS IN) Ltd For 3370 Target Rs. 210 By PL Capital- Prabhudas Lilladher

On a steady growth path

Quick Pointers: Excluding the hygiene business, revenue was up 21.4% YoY with an EBITDA margin of 18.4% indicating core stationary business is on a strong footing.

DOMS reported strong performance in 3QFY25 with revenue/PAT beat of 4%/8% respectively led by good show in the hygiene business. Revenues from Uniclan Healthcare (hygiene business subsidiary) stood at ~Rs501mn with an EBITDA margin of ~10%. As the third line has commenced production, installed capacity has increased to 650mn pieces per annum. Given the capacity expansion, we expect hygiene business to provide an additional growth fillip in FY26E. Even core stationary business is on a steady growth path with ongoing expansion in pens and pencils. Progress over the new development plan on 44- acres land parcel at Umbergaon is on track and the first building is expected to be ready by 3QFY26E. Led by the ongoing expansion of product basket and distribution network, we expect sales and PAT CAGR of 27% over FY25EFY27E. We have marginally increased our EPS estimates by ~1-4% over FY25EFY27E amid strong performance in 3QFY25 and retain BUY on the stock with a TP of Rs3,370 (60x FY27E EPS; no change in target multiple).

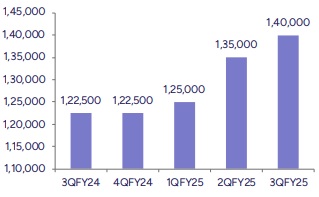

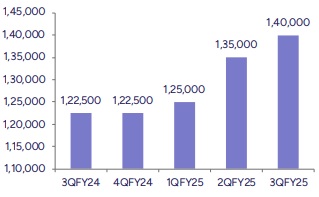

Revenue increased 34.9% YoY: Revenue increased 34.9% YoY to Rs5,011mn (PLe Rs4,831mn) driven by capacity expansion in core stationary business and consolidation of Uniclan Healthcare.

EBITDA/PAT up 26.7%/39.8% YoY: EBITDA increased 26.7% YoY to Rs879mn (PLe Rs831mn) with a margin of 17.5% (PLe 17.2%) as against 18.7% in 3QFY24. Margin compression was due to 29.0% YoY increase in employee costs to Rs702mn (PLe Rs647mn) amid new hires and ESOP grants, and an 49.7% YoY increase in other expenses to Rs601mn (PLe Rs551mn). PAT increased 39.8% YoY to Rs543mn with a margin of 10.8% (PLe 10.4%).

Con-call highlights: 1) In 3QFY25, working capital days stood at 45 excluding the hygiene business consolidation.

2) Capex of Rs1bn has been incurred in 9MFY25 with plans to spend ~Rs1.6bn-1.75bn/Rs2bn-2.25bn in FY25E/FY26E.

3) Exports fell 5% YoY, driven by a slowdown in Europe and ongoing issues in Middle East, while exports to FILA remained steady in 3QFY25.

4) DOMS has entered into an distribution agreement with FILA to export branded stationery products in markets where FILA already has an established presence opening up a new avenue for growth.

5) ClapJoy’s revenue for the quarter stood at Rs20mn.

6) Topline growth is likely to be in the range of 23-25% (inclusive of Uniclan) with EBITDA margin of ~16-17% for FY25E.

7) On a steady state basis, Uniclan's EBITDA margin is expected be in the range of 7.5-8%.

8) SKIDO's revenue was Rs30mn in 3QFY25 with an EBITDA margin of 13%.

9) Current pencil manufacturing capacity is 5.5mn per day, with plans to increase the same by an additional 2.5mn per day.

10) Exports under own brand/FILA were at Rs270mn/370mn for the quarter.

11) At peak utilization, Uniclan can generate revenue of ~Rs2.5bn-Rs3bn.

12) There is no material difference in export and domestic margins for Uniclan.

13) Prospective export markets for “Wowper” brand include Nepal, Middle East, Bangladesh, and Sri Lanka.

14) The paper stationery business grew over 50% YoY, driven by capacity expansion and partnership with ISRO and Warner Bros for licensed comic characters.

Above views are of the author and not of the website kindly read disclaimer

.jpg)