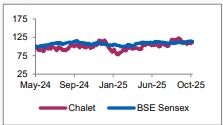

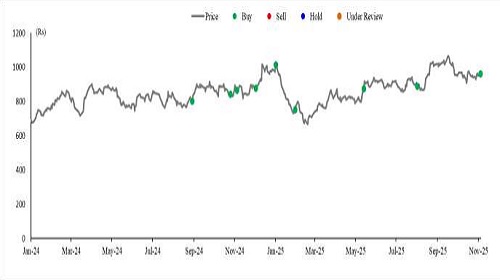

Buy Chalet Hotels Ltd For the Target Rs. 1,120 by Axis Securities Ltd

Transitions to Brand-led Platform; Launches Athiva

Est. Vs. Actual for Q2FY26: Revenue – INLINE; EBITDA – INLINE; PAT – INLINE

Changes in Estimates post Q2FY26:

FY26E/FY27E: Revenue: 5.8%/14.1%; EBITDA Abs:. 5.8%/15.7%; PAT: 11.1%/22.4%

Recommendation Rationale:

* ARR Jumps, Annuity Surges 76%: The hospitality business reported a 13.4% YoY growth, with ARR increasing to Rs 12,170 (+15.6% YoY) and occupancy reaching 67%, down 730 bps YoY.The MMR and NCR reported muted DR growth YoY, while Hyderabad and Bengaluru delivered strong ADR Growth. The rental annuity saw strong growth of 76%, driven by a 50% YoY increase in new leased area with monthly run rate of Rs 24 Cr.

* Profitability Surges on Annuity, Cost Discipline: Consolidated margins (ex-residential) stood at 42.7%, up 260 bps YoY but flat QoQ, driven by the annuity business supporting profitability and strict operating cost discipline. The company's reported PAT was Rs 155 Cr, boosted by another tranche of residential units handover.

* Chalet Launches In-House Brand 'Athiva': Chalet launched its first in house brand, “Athiva”, rebranding Duke’s Retreat Khandala (147 Keys) as first property under this platform with the aim of adding 900+ keys under this brand from other hotels in future. The company also declared its maiden interim dividend of Rs 1/share.

Sector Outlook: Positive

Company Outlook & Guidance: The company maintains a highly optimistic outlook for the H2FY26, expecting a robust performance driven by the festive season, holidays, and the commencement of the MICE season. Management views the recent dip in occupancy as a temporary "blip" on account of new inventory additions and expects occupancy levels to stabilise and return to past strong performance quickly. This positive outlook is underpinned by the sustained success of the core "double engine strategy" (hospitality and commercial real estate), which provides the solid financial foundation necessary to pursue growth, brand expansion with Athiva, and selective acquisitions.

Current Valuation: EV/EBITDA 20x for H1FY28E earnings.

Current TP: Rs 1,120/share (Earlier TP: Rs 1,030/share)

Recommendation: BUY

Financial Performance

Chalet Hotels reported revenue of Rs 735 Cr, up 95% YoY, supported by the recognition of Rs 282 Cr from residential unit sales. Excluding this, the core hospitality business delivered Rs 453 Cr, up 20% YoY but flat sequentially, as industry demand was impacted by heavy monsoon rains and delayed foreign tourist arrivals amid geopolitical tensions. Occupancy stood at 67%, down 7% YoY, mainly due to weather disruptions, the ramp-up of new inventory at Bengaluru Marriott and the Athiva - rebranded properties, and overall demand moderation.

The company launched its in-house brand, Athiva, rebranding Duke’s Retreat, Khandala, as the first property under this platform. The brand focuses on joy, wellness, and sustainability, catering to Millennials and Gen Z travellers, with plans to add five hotels totalling around 900 keys under this banner. Chalet remains on track with its development pipeline, with Taj Delhi expected to launch in H1FY27 and Cygnus II by the Q4FY27. It has also repaid Rs 200 Cr of promoter loans, signalling financial prudence, and plans a Rs 2,500 Cr capex over the next three years to support growth. Under the Koramangala residential project, around 150 units have been handed over In H1FY26, with the remainder targeted for delivery in FY27; We have factored in full revenue related to residential units in FY27E instead of FY28E.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633