Buy Brigade Enterprises Ltd For Target Rs. 1,415 by Motilal Oswal Financial Services Ltd

Scaling up in Hyderabad and Chennai; rentals to go up after FY26

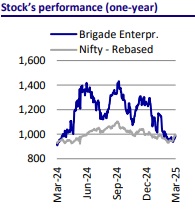

Brigade Enterprises (BRGD) posted a 36% CAGR in presales over FY20-24 and is expected to deliver more than 24% growth during FY25-27, guided by its strong launch pipeline and scale-up in Hyderabad and Chennai. Collections are expected to increase to INR94b by FY27, posting a 34% CAGR over FY24-27, which should translate into a cumulative operating cash flow of INR100b over the same period. Additionally, the commissioning of rental assets across geographies is expected to drive a 15% CAGR in rental income over FY24-27. The listing of its hospitality portfolio is also expected to bring additional cash into the company. We believe BRGD offers strong growth visibility in the coming years, and we reiterate our BUY rating with a revised TP of INR1,415/share, which implies a 44% upside.

Presales to grow 2x, aided by launches

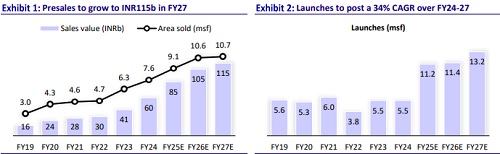

* In FY24, BRGD reported bookings of INR60b (launches contributed to ~70% of the area). In 9MFY25, BRGD launched projects such as Citrine (50% sold), Gateway (66% sold), Vantage, and new phases from existing launches, totaling 7.5msf area (6.3msf of BRDG’s share). Since Jan’25, the company has launched notable projects, including premium residential projects, Eternia (GDV INR27b) and Orchards (GDV INR3.8b), in Bangalore and an ultra-luxury project, Altius, in Chennai (GDV INR17b). These new launches strengthen BRGD’s presence in high-demand urban markets, aligning with the company’s strategy of delivering top-tier properties that cater to affluent buyers. The launch of these prestigious projects reflects BRGD’s ability to meet market demand for luxury living and mixed-use spaces. With the successful introduction of these projects, BRGD has effectively met its initial guidance of ~4msf of launches in 4QFY25.

* We expect a 24% CAGR in presales to INR115b by FY27, with a 10% CAGR in realization to ~INR10,700. This growth is estimated based on the robust launch pipeline of 15msf, as guided by the company (with 12msf dedicated to residential), of which 4msf having been already launched since Jan’25. Overall, Bengaluru is expected to contribute ~50-80% of presales. Launch volumes are expected to post a 34% CAGR over FY24-27, reaching 13.2msf by FY27.

* Although Bengaluru has been crucial in BRGD's success, the company has significantly broadened its presence by extending its operations to other key cities, including Chennai and Hyderabad, in recent years. This expansion is expected to account for 30-40% of the company's presales in the near future (total ~40% of total current land bank is for Hyderabad and Chennai). Additionally, BRGD is poised to further enhance its footprint in Kerala with the development of a World Trade Center (WTC), a project that is set to create numerous employment opportunities. The company also plans to continue to invest in Kerala for the long term to strengthen its position. Looking ahead, BRGD is preparing to enter the Mysuru market by FY26, signaling its continued growth and strategic expansions across the southern states of India.

* The upcoming launches are expected to be the key growth drivers for BRGD, while the remaining bookings will be achieved through steady sales efforts, capitalizing on the brand's robust market presence and stable demand for premium residential properties.

* About 85% of presales in FY27 are expected to come from new projects, while the remaining will come from stable sales.

BRGD's strategic expansion: Key developments in Kerala, Chennai, and Bengaluru

* BRGD is set to expand its footprint in Kerala by developing a WTC in Thiruvananthapuram featuring 1.5msf of office space. The group has already signed and initiated the expansion of the WTC in Kochi Infopark with its third tower, bringing its IT infrastructure to 1msf. It also plans to invest INR15b in Kerala over the coming years, and the development is expected to generate employment opportunities.

* BRGD has also signed a joint development agreement for a residential project of ~1msf located in West Chennai with a GDV of ~INR8b. The project will be developed as part of a 1.5msf mixed-use development.

* BRGD has signed a definitive agreement to buy a prime land parcel located on the Whitefield-Hoskote Road, Bengaluru, to develop a residential project spanning 20 acres. The project will have a total saleable area of ~2.5msf with a GDV of about INR27b and a total land cost of about INR6.3b through its subsidiary Ananthay Properties.

* Overall, BRGD has added 8msf of land in YTD FY25 with a GDV of INR100b. There is still INR9b left to be allocated to land acquisition, and the company is currently evaluating potential projects for expansion in Hyderabad. These new developments will enhance the company’s existing pipeline and increase the visibility of future launches.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412