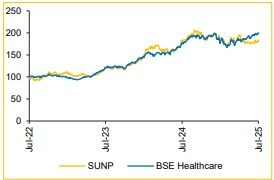

Add Sun Pharmaceutical Industries Ltd For Target Rs. 1,825 By Choice Broking Ltd

Growth Visibility Intact Despite Near-Term Margin Pressure

We expect Sun Pharma to continue delivering healthy growth driven by new launches, particularly from its innovative pipeline. While margins may see a temporary blip due to increased investments in promotional activities and R&D— especially for pipeline development in areas like GLP-1 agonists—these are likely to normalize by FY27E as high-margin launches scale up. The company also benefits from a strong US manufacturing base, which provides insulation against tariff-related risks, and management has indicated no plans for further expansion of this base.

Factoring in the expected normalization of tax rates, we have revised our earnings estimates downward by 6.6%/5.3% for FY26E/FY27E. We value the stock at 30x (unchanged) the average of FY27E and FY28E EPS, arriving at a target price of INR 1,825 (unchanged), and maintain our ADD rating.

EBITDA Beat with Strong Margin Expansion; PAT Misses on One-Time

* Revenue grew 9.5% YoY / 6.9% QoQ to INR 138.5 Bn (vs. consensus estimate: INR 137.0 Bn).

* EBITDA increased 19.2% YoY / 15.8% QoQ to INR 43.0 Bn; margins expanded 254 bps YoY / 238 bps QoQ to 31.1% (vs. consensus: 28.0%).

* Reported PAT declined 1.3% YoY / 20.2% QoQ to INR 22.8 Bn (vs. consensus estimate: INR 30.4 Bn), with an PAT margin of 16.5%.

* Adjusted for exceptional items, PAT stood at INR 28.7 B

Ilumya, Leqselvi Launch to Anchor Next Phase of US Expansion

In the US, growth was led by new launches, which offset the decline in the generics portfolio. We expect momentum to improve further with upcoming launches like Leqselvi (launched in July 2025 for severe alopecia) and Unloxcyt (acquired via Checkpoint Therapeutics, launch expected in H2FY26). Ilumya’s Phase 3 trials have met primary endpoints, and the company anticipates filing by CY25. These developments continue to shift the US revenue mix toward highvalue, innovative therapies.

India to Sustain IPM Outperformance Through Pipeline Strength

The company’s India business posted healthy growth in Q1FY26, driven by volumes and new launches, contrasting with the price-led growth seen in the IPM. As per Pharmarack (June 2025), the company holds an 8.3% market share vs 8.0% last year. During the quarter, it launched five new products, maintaining its focus on prescription-led growth over OTC. It also aims to be part of the first wave of GLP-1 launches in India, targeting early market entry. We believe the company is well-positioned to continue outperforming overall IPM growth.

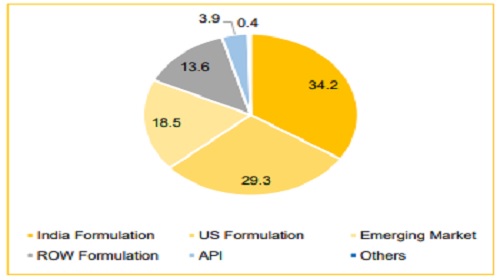

Q1FY26 Segment Revenue Split (INR 138.5 Bn)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131