Buy Bharat Dynamics Ltd for the Target Rs. 1,965 by Choice Institutional Equities

Business Overview:

BDL, established in 1970, is a Government of India enterprise under the Ministry of Defence. It is a leading manufacturer of strategic defence systems, including surface-to-air missiles (SAMs), air-to-air missiles (AAMs), antitank guided missiles (ATGMs), torpedoes and allied defence equipment. Headquartered in Hyderabad, BDL operates three manufacturing units in Telangana and Andhra Pradesh, with new facilities under development in Maharashtra, Telangana and Uttar Pradesh. The company has also expanded into defence exports and forged strategic partnerships with both the public and private sectors, strengthening its position as a key contributor to India’s defence ecosystem.

What is BDL’s medium- to long-term growth outlook?

In our view, BDL is uniquely positioned in India’s defence ecosystem, with its strongest moat being in the missile and air defence domain. Post-Operation Sindoor, the government realised that India needs a robust, multi-layered air defence shield to counter incoming aerial threats, particularly ballistic and cruise missiles. Pakistan’s deployment of ballistic systems during the conflict served as a wake-up call, pushing the government to accelerate the procurement of advanced air defence systems. We believe this shift has structurally changed the demand trajectory for BDL’s core offering.

BDL today stands as the lead system integrator for India’s frontline missile platforms, including the Akash Missile Systems, MR-SAM, LR-SAM and the upcoming Akash-NG. These platforms form the backbone of India’s layered air defence architecture. In addition, BDL’s portfolio is not restricted to air defence alone; it extends into Anti-Tank Guided Missiles (ATGMs) and strategic weapon systems, making it an indispensable partner for the armed forces.

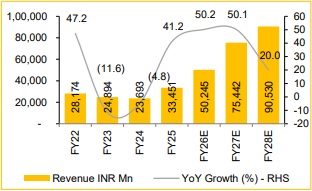

In our opinion, BDL is not just another PSU defence manufacturer—it is a strategic enabler of India’s deterrence capability. With a growing order book and a clear policy tailwind, we expect revenue to compound at a healthy 30– 40% CAGR over the next 3–5 years, supported by improving margin as scale builds.

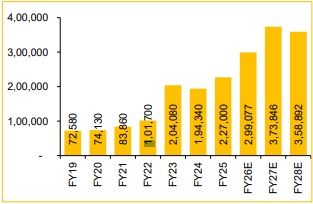

What makes BDL a strong investment opportunity

We believe BDL stands out as a compelling play on India’s defence indigenisation theme. A significant 90–95% of its product portfolio is indigenised, insulating the company from any risk of import restrictions and aligning it firmly with the government’s Atmanirbhar Bharat vision. We think this provides long-term policy support and de-risks its supply chain. Moreover, BDL’s robust unexecuted order book stands at ~7.1x FY25 revenues and is executable over the next 5–6 years, lending strong earnings visibility and growth stability. We expect this to drive consistent performance even amid short-term execution challenges.

Importantly, the company has a healthy project pipeline worth INR 200 Bn over the next 2–3 years, which should further strengthen its positioning in the defence value chain. We also like BDL’s diverse manufacturing portfolio spanning strategic missiles, underwater weapons and countermeasure systems, which reduces dependence on a single program. In our view, BDL remains strategically aligned with the Ministry of Defence’s longterm procurement roadmap, and we expect it to be a key beneficiary of rising domestic defence spending.

Near-term catalysts:

1) INR 200 Bn order pipeline, 2) Expecting strong export orders, and 3) Potential global OEM partnership.

Valuation:

At present, we have a “BUY” rating on the stock with a Target Price of INR 1,965.

Key Risks:

1) Dependence on other platform manufacturers to deliver BDL platforms, 2) Possible changes in defence policies, 3) Probable economic downturn, and 4) Likely shifting of government priorities. These can reduce demand for defence products and services.

Revenue expected to expand 39.2% CAGR over FY25-28E

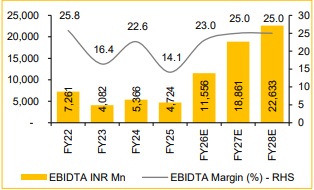

EBITDA Margin to improve led by better mix

Strong order book position (INR Mn)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131