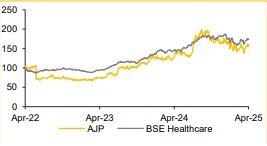

Buy Ajanta Pharma Ltd. For Target Rs.3,180 - Choice Broking Ltd

Expansion-Driven Margin Pause; BUY on Strong Pipeline

AJP is currently in an investment phase, expanding its presence across geographies and therapeutic areas. As a result, the company expects higher promotional and employee expenses, which will likely cap EBITDA margin improvements until post-FY27E. Reflecting this outlook, we have revised our FY26E/FY27E earnings estimates downward by 6.2%/6.1%, respectively. However, we maintain our BUY rating on the stock and revise our target price to INR 3,180 (revised down from INR 3,667 in Q3FY25) by averaging our PE-based and DCF-based valuations. For the PE method, we apply a multiple of 30x on FY27E EPS, (in line with comparable generics peers in terms of growth, returns, and margins). Our DCF-based valuation (refer Exhibit 1) suggests a slightly higher upside, but we believe the blended approach offers a more balanced view of near- and long-term value drivers

Revenue Beat Led by US Generics; EBITDA Margin and PAT Below Estimates:

Revenue grew 11.0% YoY / 2.1% QoQ to INR 11.7 Bn (vs. consensus estimate: INR 11.4 Bn), driven by strong US generics growth (up 24.5% YoY / 23.6% QoQ). EBITDA rose 6.8% YoY but declined 7.4% QoQ to INR 2.9 Bn; margins contracted 102 bps YoY / 260 bps QoQ to 25.4% (vs. consensus: 28.0%). PAT increased 11.1% YoY but declined 3.3% QoQ to INR 2.3 Bn (vs. consensus estimate: INR 2.9 Bn).

US Generics Set for High-Teen Growth on Strong Launch Pipeline:

US generics delivered strong growth during the quarter, driven by solid market execution and new product launches. The company launched four new products—Oxtellar XR (launched as an authorized generic from Supernus), Fluvoxamine ER, and two undisclosed molecules—which are expected to support growth in FY26. Additionally, the company plans to launch seven more products in FY26. With a strong pipeline and the ramp-up of recent launches, we expect US generics to maintain strong momentum, in line with management’s guidance of high-teen growth.

Asia Branded Generics to Grow 15% in FY26; Segment Outlook Remains Positive

Branded generics (Asia + Africa) now account for 41.8% of total revenue. The company launched 25 new products in the Asia branded segment and 13 in Africa, with a primary focus on chronic therapies. We expect Asia branded generics to maintain strong momentum, growing at 15% in FY26, while growth in the Africa segment is likely to remain moderate amid a broader market slowdown. Overall, we project the branded generics segment to grow in the low double digits.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)