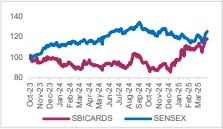

Buy SBI Cards and Payment Services Ltd for the Target Rs. 1,050 by Axis Securities Ltd

Light At the End of the ‘Credit Cost’ Tunnel; Upgrade to BUY!

Est. Vs. Actual for Q4FY25: NII – INLINE; PPOP – INLINE; PAT – BEAT

Changes in Estimates post Q4FY25

FY26E/FY27E (in %): NII +2.6/+3.0; PPOP +1.8/+1.0; PAT +2.2/+0.5

Recommendation Rationale

* Credit costs to taper: SBIC efforts to strengthen the new acquisition, underwriting and portfolio management framework to tackle the rising stress in the credit card portfolio have started to yield results. The company is seeing improvement across asset quality metrics with a decline visible in delinquencies (both 30+dpd and 90+dpd), forward flows and pace of writeoffs. Thus, the management remains confident that credit costs will continue to decline in the coming quarters, thereby aiding earnings growth for SBIC. The company has been witnessing better delinquency trends in the new sourcing, with the portfolio continuing to behave well. However, normalisation of credit costs will take some time. A faster decline in credit costs would act as a catalyst for a meaningful re-rating in the stock. We expect credit costs to taper meaningfully to 8.4%/7.2% in FY26/27E vs 9.5% in FY25.

* NIMs to improve aided by rate cuts: In Q4FY25, SBIC’s NIMs surprised positively aided by improvement in CoF and better yields. With the rate easing cycle, we expect SBIC will stand to benefit given its largely fixed rate book and a downward repricing of CoF, though with a lag. Moreover, receding asset quality stress resulting in lower interest reversals would further support margins. SBIC’s CoF would see a decline going into Q1FY26 and beyond. While the revolver book rates are fairly sticky, the company may pass on the benefit of the rate cut to its EMI customers. The management remains confident of maintaining NIMs with a positive bias. A risk to our NIM improvement estimates is the decline in the share of revolvers in the portfolio mix. SBIC has observed a downward bias in customers’ tendency to revolve in the newly sourced customer cohort (lower by 10-15%). Thus, going ahead, the share of revolvers is likely to settle at ~23% vs 24-25% currently. We believe improving CoF and lower interest reversals would largely offset the impact of a potentially lower share of revolvers. We expect NIMs to improve and range between 11.3-11.6% over FY26-27E vs 10.8% in FY25.

* Corporate spends to pick-up: Post repositioning itself in terms of corporate spends, the company is set to push the growth pedal and expects the corporate spends to pick up healthily hereon (barring the seasonality seen in Q4). While SBIC intends to increase corporate spends, it will pursue growth judiciously and profitably. Improved corporate spends would support fee income for the company. With retail spends growth showing strength, SBIC expects 18-20% growth in FY26. As spends growth picks-up, especially corporate spends, SBIC will look at reclaiming its lost spends market share.

Sector Outlook: Cautiously Positive

Company Outlook: Asset quality concerns and elevated credit costs had been key reasons for the stock to underperform. With asset quality metrics improving, we expect credit costs to continue moving downwards, thereby driving robust earnings growth for SBIC. We believe SBIC is ripe for a re-rating supported by (i) expectations of NIM improvement, (ii) strengthening fee income profile, (iii) steady Cost ratios ranging between 55-57% on a steady state and (iv) declining credit costs driven by improving asset quality parameters, however growth picking-up would drive a meaningful re-rating. We expect SBIC to deliver a Receivables/NII/Earnings growth of 15/18/42% CAGR over FY25-27E. Our estimates suggest SBIC’s RoA/RoE to improve to 4.8/21.8% by FY27E vs 3.1/14.8% in FY25

Current Valuation: 26x FY27E EPS Earlier Valuation: 24x Sep’26E EPS

Current TP: Rs 1,050/share. Earlier TP: Rs 780/share

Recommendation: We revise our rating from HOLD to BUY.

Financial Performance:

* Operational Performance: SBIC’s CIF grew by 10/2% YoY/QoQ. The company added ~11.1 Lc cards during the qtr (+8/-6 YoY/QoQ). Spends growth was better than expected and grew by 11/3% mainly owing to better corporate spends. Retail spends grew by 15% YoY and were flattish QoQ. SBIC maintained market share in terms of Spends QoQ which stood at 15.6% and was able to gain CIF market share which stood at 18.9% vs 18.7% QoQ. Receivable growth missed our expectations and stood at ~10/2% YoY/QoQ with the mix of interest yielding assets marginally down to 59% vs 60% QoQ.

* Financial Performance: NII grew by 14/3% YoY/QoQ with NIMs improving QoQ (by 60bps QoQ) on account of improving CoF and better yields. CoF declined by 20bps QoQ, while yields improved by 50bps QoQ. Fee income growth was muted at 5/4% YoY/QoQ. Opex growth was under control, grew by 8% YoY and de-grew by ~2% QoQ. C-I Ratio stood at 51.4% vs 51.1/53.5% YoY/QoQ. PPOP grew by 7% each YoY/QoQ. Credit costs moderated to 9% vs 9.5% in the previous qtr, supporting earnings. PAT grew by 39% QoQ.

* Asset Quality improved, with GNPA/NNPA at 3.08/1.46% vs. 3.24/1.18% QoQ. Stage 2 assets came down from 5.6% in Q3FY25 to 5% in Q4FY25.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)