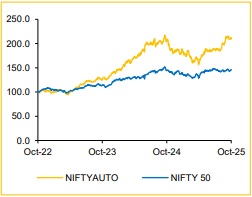

Automobile and Automobile Ancillaries : Q2FY26 Results Preview by Choice Institutional Equities

GST reforms propel auto sales, festive season adds momentum

* We maintain a positive outlook for India’s automobile industry, supported by multiple structural and cyclical tailwinds. The recent GST restructuring has provided a significant boost to India’s automobile sector, driving demand revival – especially among price-sensitive buyers impacted by rise in costs due to stricter emission norms and OEM-led price hike. Owing to this, along with the onset of the festive season, the two-wheeler, passenger car and tractor segments saw strong sales towards the end of Q2FY26.

* Additionally, China lifting restrictions on rare earth magnet exports to India offers short- to medium-term relief for EV and auto component manufacturers, though long-term resilience remains a priority.

* On the domestic front, strong rural demand – supported by an above-normal monsoon (106–108% of LPA) and increased kharif sowing – has improved rural sentiment, aiding demand for twowheelers and tractors.

Q2FY26 Expectations:

* In Q2FY26, OEMs under our coverage (ex-Tata Motors) are expected to register a 15.6% YoY increase in revenue, supported by a strong demand for the festive season and a pipeline of new model launches. In OEMs, EIM is likely to lead the pack with 42.5% YoY revenue growth, followed by MM at 27.1% and TVSL at 26.3%.

* On the auto ancillaries front, revenue is projected to expand by 16.2% YoY, driven by a shift towards premiumisation, leading to a rise in content per vehicle. LMAX is projected to lead with a revenue growth of 26.0% YoY.

Automobile OEMs:

* The OEMs under our coverage are expected to post a strong set, with aggregate Revenue/EBITDA/PAT increase of 15.6%/6.9%/11.5% YoY. Growth is driven by a surge in demand, aided by GST rate changes and the onset of the festive season towards the end of the quarter.

* The PV companies under our coverage are anticipated to post mixed results with a 12.7% YoY revenue growth. In the 2W segment, the OEMs are expected to expand 18.9% on a YoY basis.

* The CV segment has started recovering after a challenging year with volume decline; AL is expected to post 11.6% YoY revenue growth.

Automobile Ancillaries:

* The ancillaries under our coverage are projected to deliver strong growth in Q2FY26, driven by robust demand and a shift towards premiumization. Aggregate Revenue/EBITDA/PAT growth is expected at 16.2%/22.2%/28.5% YoY, reflecting healthy performance.

* Among the companies, LMAX is anticipated to lead with 26.0% YoY revenue increase. ENDU and LUMX are projected to post 19.7% and 19.2% YoY revenue growth, respectively.

High-conviction investment ideas:

We maintain a positive stance on MM and LMAX, which are expected to deliver strong growth in Q2FY26.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131