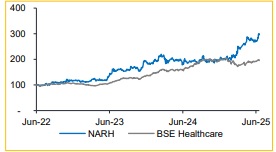

Add Narayana Hrudayalaya Ltd For Target Rs. 2,110 - Choice Broking Ltd

Narayana Health City, Bangalore

We visited Narayana Health City, Bangalore, and met with Mr. Nishant Singh - VP Finance / Head of Treasury and Dr. Nitin Manjunath – Director – Narayana Health City & Corporate Growth Initiatives.

Management guidance: EBITDA margin gains are led by the Cayman ramp-up (~25% of revenue with ~45% EBITDA margin) and strong return ratios. The company aims to scale new facilities, pursue value-accretive acquisitions, and maintain cardiac care’s revenue share above 25%.

Post-visit changes & Valuation: Post-visit, we have marginally improved our estimates for FY27 and valuation multiple from 22x to currently valuing at 24x to arrive at a revised target price of INR 2,110 (from INR 1,900) and maintained the rating to ADD.

About the facility: Narayana Health City in Bangalore is a one-stop healthcare destination, several super-speciality and tertiary care facilities.

* The facility consists of ~1,500 bed capacity comprising multiple hospitals including 1) Mazumdar Shaw Medical Centre, offering super-speciality services, with ~770 bed capacity, 2) Narayana Institute of Cardiac Sciences, offering multi-speciality services, with ~600 bed capacity, and 3) Sparsh Hospital for Orthopaedic, Spine & Joint Replacement.

Expansion Plan: Expansion is limited to Bangalore (4 hospitals, 885 beds), Kolkata (1 hospital, 350 beds), and Raipur (1 hospital, 300 beds), with most facilities expected to commence operations in over 3 years.

* The strategy avoids large 500-bed hospitals, focusing instead on 2–3 midsized facilities (150–250 beds) across multiple locations.

* The company is seeking approval for adult treatment at its Mumbai facility, which is expected to support early EBITDA breakeven.

* International expansion is planned in a developed market (excluding Cayman), with funding sourced from Cayman operations.

Growth in the Operating Metrics:

* International Patient: The company does not actively target international patients and has no broker tie-ups; the ~4% international revenue is organically driven by Dr. Devi Shetty’s reputation and the Narayana brand. The focus remains catering to international patients through its planned overseas expansion.

* ARPOB: We are expecting it to reach INR 43,500 by FY27(from INR 34,800 in FY25, growing by 10-12% every year).

* ALOS is currently high due to cardiac treatments, particularly pediatric cases in Mumbai, where stays often extend 10–20 days, along with other complex surgeries. The target is to reduce from 4.5 to 4 days.

* Payer Mix: The share of govt business is expected to remain at ~19%.

* Robotics Surgery: The company anticipates a significant rise in robotic surgeries. However, it emphasizes that doctors will remain essential—to operate the robots and to make critical, emotion-driven clinical decisions.

* Indian Occupancy: The India business operates at an average occupancy of ~60%, ranging between 58–65% quarterly. However, with occupancy consistently reaching ~70% in cities like Bengaluru and Kolkata, the company is expanding capacity in these regions to meet growing demand. We expect occupancy to remain at 60%.

* Cayman Margins: Achieving ~45% EBITDA margin is rare in other countries, driven here by a smaller, high-income population—making this level of profitability difficult to replicate elsewhere.

* Cayman Speciality mix: No single therapy holds a dominant share (>20%); instead key specialties like nephrology, cardiology, and oncology each accounting for 10–15% of revenue.

Risks to our investment case: Delays in the execution of planned projects and corporate governance issue.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131