Add Hyundai Motor India Ltd For Target Rs. 1,750 By Emkay Global Financial Services Ltd

FY26 growth, margin outlook muted; valuation reasonable

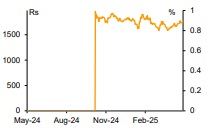

HMIL posted a 4%/20% beat on consensus revenue/EBITDA (supported by lumpy government subsidies). While EBITDA margin expanded by 285bps QoQ on improvement across operational parameters (60bps benefit from pricing actions/lower discounts amid better product mix), HMIL lost ~100bps market share in Q4FY25 on YoY basis. HMIL targets growing in line with the underlying PV industry (~1-2% in FY25) given weaker domestic demand, and 7-8% growth in exports in FY26 (implying 3% overall volume growth). The upcoming Talegaon plant is likely to weigh on near-term margin (due to frontloading of costs, higher depreciation) which drives a ~2% cut in FY26E EPS. HMIL has established a strong franchise in India, though the muted FY26E growth outlook and margin pressure from new plant restrict us from turning more positive on the stock. We build in 8%/7% revenue/core-EPS CAGR over FY25-27E and retain ADD with unchanged TP of Rs1,750 at 23x FY27E core PER. We continue to prefer MSIL on better ICE launch visibility (refer to our recent note)

Steady Q4; beat across operational parameters

Consol revenue was up 1.5%YoY to Rs179.4bn (above consensus’); this led to flattish volume, with ASP up 5% QoQ on better product mix, pricing actions (per the company, discounts were 2% of the ASP in Q4 vs 2.6% in Q3), and benefit from ~Rs1bn higher operating income (FY25 GoI subsidies received in Q4). Consol EBITDA was flat YoY at Rs25.3bn, with margin up by ~285bps QoQ to 14.1%, backed by gross margin expansion and lower staff costs/other expenses. Reported PAT was down 4% YoY to Rs16.1bn.

Earnings call KTAs

1) HMIL targets growing in line with the underlying PV industry amid weak domestic demand, and 7-8% exports growth. The management remains cautiously optimistic about a demand rebound, aided by rate cuts and tax relief. 2) HMIL foresees no major near-term improvement in the hatchback segment owing to the ongoing premiumization trend and higher SUV share. 3) FY25 volume was impacted by a high base and weak urban demand, though pricing actions (0.6% price hike in Jan-25) and favorable product mix (higher SUV/export share) supported ASPs. 4) Localization level, now at 85% (vs 78% in FY24), is seen aligning with HMIL’s long-term strategy of deepening local sourcing. 5) The Q4 other operating income was higher by ~Rs1bn due to MoU-linked government incentives (tax incentives, ~Rs250mn clean energy vehicle subsidy, ~Rs750mn capital subsidy). 6) The Talegaon plant to operationalize from Q3FY26, with flexibility for ICE and EV models; depreciation from the plant may weigh on near-term profitability, though volume and export ramp-up should offset this, over time. 7) HMIL targets 30% export share by 2030 (vs 22% now), aided by ~1.1mnpa capacity following ramp-up of the Pune plant. India is set to become Hyundai’s largest export hub outside Korea. 8) 26 new models planned over 5 years (20 ICE, 6 EVs, incl hybrids) of which 8 expected during FY26-27. Strategy includes increasing feature content on lower trims instead of cutting prices/offering higher discounts. 9) FY26 capex guidance at Rs70bn, with ~40% toward the Pune plant and ~25% for new product development.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354