Add Hindustan Unilever Ltd For Target Rs. 2,670 By Yes Securities Ltd

Muted quarter; Commentary not comforting

Hindustan Unilever’s (HUVR) 3QFY25 performance was slightly below our already subdued expectations. Underlying Volume Growth (UVG), which was flat this quarter, was hurt by negative mix even while tonnage growth was positive this quarter. Apart from impact on soaps business from earlier actions and delayed winter hurting skin care, there was pressure from moderation in urban growth and unfavorable mix from faster growth in smaller packs. While HUVR expects movement to small packs to reverse, there is still no visibility on demand improvement. Commodity inflation coming-off from recent highs and full absorption of price increases will support margins in near-term as HUVR ups it spend towards launches/innovations especially in the Beauty & Wellbeing (B&W) portfolio. With 2-3% downward revision in EPS and targeting 50x on FY27E EPS, we now get a revised target price (TP) of Rs2,670. We upgrade our rating a notch to ADD.

Result Highlights

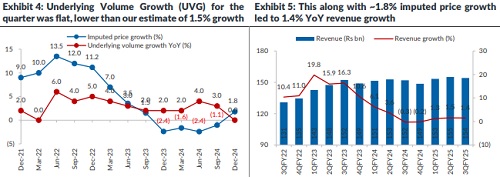

* Headline performance: HUVR’s standalone turnover (including other operating incomeOOI) for 3QFY25 grew by 1.4% YoY to Rs154.1bn (vs est. Rs157.2bn). EBITDA was flat YoY at Rs35.7bn (vs est. Rs36.4bn). Recurring PAT (PAT bei) was flat YoY to Rs25.4bn (vs est. Rs25.98bn). Reported PAT grew by 19.1% YoY to Rs30bn largely on account of profit from the divestment of ‘Pureit’ business.

* UVG for 3QFY25 was flat, slightly below our est. of 1.5%.

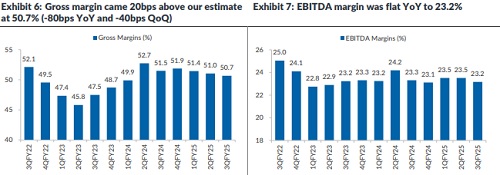

* Margins (Please note, our margins calculated with revenue (Sales+OOI) in denominator and not sales.): Reported gross margin came in at 50.7%, down ~80bps YoY (-40bps QoQ). While EBITDA margin was flat YoY at 23.2% (in-line). A&SP was down 100bps YoY to 9.5% (down 8% on absolute basis) while other expenses was flat YoY and staff costs increased by 20bps YoY.

* 9MFY25 performance: Revenue, EBITDA and Recurring PAT grew by 1.4%, 0.6% and 0.2% YoY, respectively. Gross margin is down 30bps YoY at 51% while EBITDA margin is down 20bps YoY to 23.4%.

Key near-term outlook:

(1) Moderation in consumption trends to continue in near term. (2) Tea and Palm Oil have come-off from recent highs. Commodity basket looks benign now. At current commodity levels, expect low-single digit price growth. (3) EBITDA to be maintained at the lower end of 23-24% range. (4) Recent strategic initiatives: (a) Divestment of water business “Pureit”, (b) Demerger of ice-cream business, (c) Acquisition of “Minimalist” & (d) Acquisition of the palm oil undertaking of Vishwatej Oil Industries Pvt Ltd.

View & Valuation

Some improvement in volume growth along with low-single digit pricing (anniversarization of earlier price actions + additional calibrated price hikes in soaps & tea) and no major improvement in EBITDA margins from current levels of 23-24% leads to just ~2% earnings growth in FY25 (building 8-9% earnings growth in 4QFY25). With 2-3% downward revision in EPS, we now expect HUVR to deliver ~6% revenue CAGR over FY24-27E led by ~4% volume CAGR. With gross margin recovery starting FY26, we believe EBITDA margin will now see a modest improvement of ~50bps over FY24-27E. We thus estimate a subdued 7.5% earnings CAGR over the same period. HUVR is now currently trading at ~53x/48x/44x on our FY25E/FY26E/FY27E EPS as we build revenue/EBITDA/APAT CAGR of ~6%/6.7%/7.5% over FY24-27E. Targeting 50x on FY27E EPS, we now get a revised target price (TP) of Rs2,670. We upgrade our rating a notch to ADD.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632