Accumulate Marico Ltd For Target Rs.787 by Prabhudas Liladhar Capital Ltd

Healthy demand outlook, margin recovery likely post 2H26

Quick Pointers:

* VAHO posts ~16% growth while Saffola delivers flattish volume growth

* EBITDA margin to see ~200bps expansion in FY27, Rs200bn revenue by FY30

* MRCO guided for ~25% revenue and double-digit EBITDA growth in FY26

We have increased our FY27/FY28 estimates by 2.3%/3.0% given 1) healthy demand outlook for 2H 2) Sustained market share gains across key portfolio. 3) Focus on urban-centric and premium portfolio drive margins post 2HFY26 and 4) Innovation funnel remains strong with portfolio diversification and scale up in Foods, D2C portfolio & B2C acquisitions. Company remains committed towards Sustained investment in Foods with 25%+ CAGR in sales, supported by scaling existing franchises and continued innovation. MRCO delivered 30.7% revenue growth along with ~7% volume growth led by prices hikes in core portfolio amidst sharp inflation in key input prices, robust growth in Foods and Premium Personal Care along with sustained recovery in VAHO despite impact of GST transition. Beardo has double-digit EBITDA margins whereas Plix has maintained its strong momentum. MRCO plans to adopt the same strategy for scaling Digital-first franchises and targets double-digit margins by FY27.

Given sharp spike in copra prices, MRCO has taken another price increase in Q226. We expect margins to remain under pressure until Q4 even as improving profits in Foods and B2C will provide some respite. However, we expect margins to improve post 2HFY26 driven by premiumization with strong sales momentum in B2C & Foods and revival of growth in VAHO. We estimate a CAGR of 15.9% in EPS over FY26-28. We value MRCO at 48x Sep27 EPS and assign a target price of Rs 787 (Rs 778 earlier). Retain Accumulate

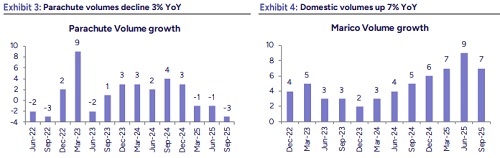

Sales up 30.7%, Domestic Volume up 7% (Ple: 8%) whereas Parachute volumes down 3%. Revenues grew by 30.7% YoY to Rs34.8bn (PLe: Rs34.49bn).Volume Growth: Parachute up 7% (PLe: 8%). Gross margins contracted by 814bps YoY to 42.6% (Ple: 44.0%) amidst sharp inflation in key commodities. EBITDA grew by 7.3% YoY to Rs5.6bn (PLe: Rs 5.4bn); Margins contracted by 351bps YoY to 16.1% (PLe:15.8%). A&P Spends contracted by 98bps YoY to 9.9%. Adj. PAT increased by 10% YoY to Rs4.3bn (PLe:Rs4.12bn)

International business: Bangladesh posted 22% CCG, maintaining its robust growth momentum on the back of the steady core business and scale up of new franchises, medium-term growth outlook of the business remain intact. Vietnam grew 6% in CCG, exhibiting signs of a gradual recovery. MENA delivered 27% CCG, with both the Gulf region and Egypt recording strong growth. While South Africa recorded 1% CCG, and management remains confident of a recovery in H2FY26. NCD and Exports recorded 53% growth.International business: Bangladesh posted 22% CCG, maintaining its robust growth momentum on the back of the steady core business and scale up of new franchises, medium-term growth outlook of the business remain intact. Vietnam grew 6% in CCG, exhibiting signs of a gradual recovery. MENA delivered 27% CCG, with both the Gulf region and Egypt recording strong growth. While South Africa recorded 1% CCG, and management remains confident of a recovery in H2FY26. NCD and Exports recorded 53% growth.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271