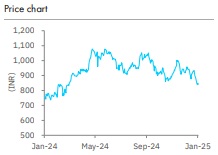

Accumulate Jindal Steel and Power Ltd For Target Rs. 991 By Elara Capital Ltd

Capex scope widens

Jindal Steel and Power’s (JSP IN) Q3FY25EBITDA of ~INR 21bn was broadly in line with our estimates of ~INR 22bn but slightly below Consensus estimates of ~INR 23bn. Consolidated net sales were flat YoY but up ~5% QoQ to ~INR 118bn, in-line with our/Consensus estimates of ~INR 114bn/INR 117bn, respectively. Adjusted PAT was down ~52% YoY but grew ~13% QoQ to ~INR 9.1bn. Key highlight from Q3FY25 results was announcement of new capex of ~INR 160bn, along with ongoing capex of ~INR 74bn, likely to be spent in FY26-28. We believe this new capex may be an overhang in the near term. We cut our EBITDA estimates by ~13% for FY25E, ~11% for FY26E and ~10% for FY27E, to factor in weak steel prices. We roll over to March 2027E from September 2026E and lower our TP to NR 991 from INR 1,102. The company has higher exposure to long products than peers. We expect demand-supply scenario to be more favorable for long products compared with flat products. Thus, we reiterate Accumulate.

Longs come to rescue, QoQ fall in EBITDA/tonne lower than peers:

Consolidated sales volume grew ~5% YoY/3% QoQ to 1.9mn tonnes. Further, realization was down ~4% YoY but rose ~2% QoQ to INR 61,846/tonne. Operating cost increased ~3% YoY/QoQ each to INR 50,620/tonne, as benefit of lower coking coal prices was offset by a rise in iron ore prices. Therefore, EBITDA/tonne declined ~27% YoY/~2% QoQ (versus QoQ fall of ~23% for Tata Steel and ~6% for JSW Steel) to INR 11,226 versus our estimates of INR 11,835. As per management, a QoQ reduction of USD 10/tonne in coking price along with an INR 100- 200/tonne reduction in iron ore prices QoQ, should benefit Q4 performance. JSP is also expected to benefit from seasonal demand for long products in busy construction period in the near term.

Net debt increases on higher capex spend:

Net debt rose to ~INR 136bn as of December 2024 versus ~INR 125bn as of September 2024 and ~INR 91.2bn as of December 2023, due to higher capex spend. We expect net debt to fall to ~INR 102bn by FY27E as JSP is likely to generate free cash flow of ~INR 63bn over the next two years.

Maintain Accumulate; TP pared down to INR 991:

We believe the negative impact of weakness in steel prices is likely to be partially offset by lower coking coal and iron ore prices and increased use of captive iron ore in Q4FY25E. In the long term, rising share of captive coal consumption, better product mix, phase-wise completion of announced capacity expansion and several cost saving measures should support performance. Therefore, we reiterate Accumulate.

We cut our EBITDA estimates by ~13% for FY25E, ~11% for FY26E and ~10% for FY27E, to factor in weak steel prices. We roll over to March 2027E from September 2026E and lower our TP to NR 991 from INR 1,102. We ascribe 6.0x (from 6.5x) March 2027E EV/EBITDA to standalone business and 4.0x (unchanged) March 2027E EV/EBITDA to other business. Increased imports of low-cost material from China and other countries, unprecedented rise in coking coal & iron ore prices, and demand slowdown from key enduser industries are key risks to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933