Nifty Open Interest Put Call ratio rose to 0.87 levels from 0.77 levels - HDFC Securities Ltd

SHORT COVERING UP WAS SEEN IN NIFTY & BANK NIFTY FUTURES

Create Longs with the SL Of 22850 Levels.

* The Nifty finally snapped its eight-session losing streak, posting a modest gain of 30 points, or 0.13%, to close at 22,959.50. After hitting early morning lows, the index staged an impressive recovery of nearly 250 points, demonstrating resilience.

* Short Covering was seen in the Nifty Futures where Open Interest fell by 0.04% with Nifty rising by 0.13%.

* Short Covering was seen in the Bank Nifty Futures where Open Interest fell by 1.82% with Bank Nifty rising by 0.32%.

* Nifty Open Interest Put Call ratio rose to 0.87 levels from 0.77 levels.

* Amongst the Nifty options (20-Feb Expiry), Call writing is seen at 23100-23200 levels, indicating Nifty is likely to find strong resistance in the vicinity of 23100-23200 levels. On the lower side, an immediate support is placed in the vicinity of 22800-22700 levels where we have seen Put writing.

* Short covering was seen by FII's’ in the Index Futures segment where they net bought worth 588 cr with their Open Interest going down by 1197 contracts.

Nifty

Trend remains down; Momentum would pick up from lower levels.

Nifty Pharma Index

Indicators & Oscillators are Weak; Trend reversal at 21500

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

Ltd ( 1 ).jpg)

Tag News

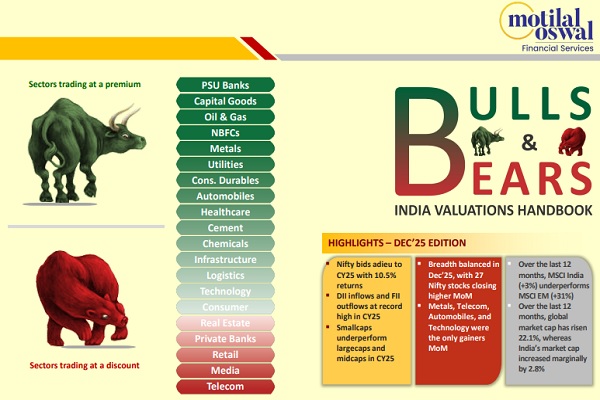

India Strategy : Indian market manages double-digit gain in volatile CY25 by Motilal Oswal F...