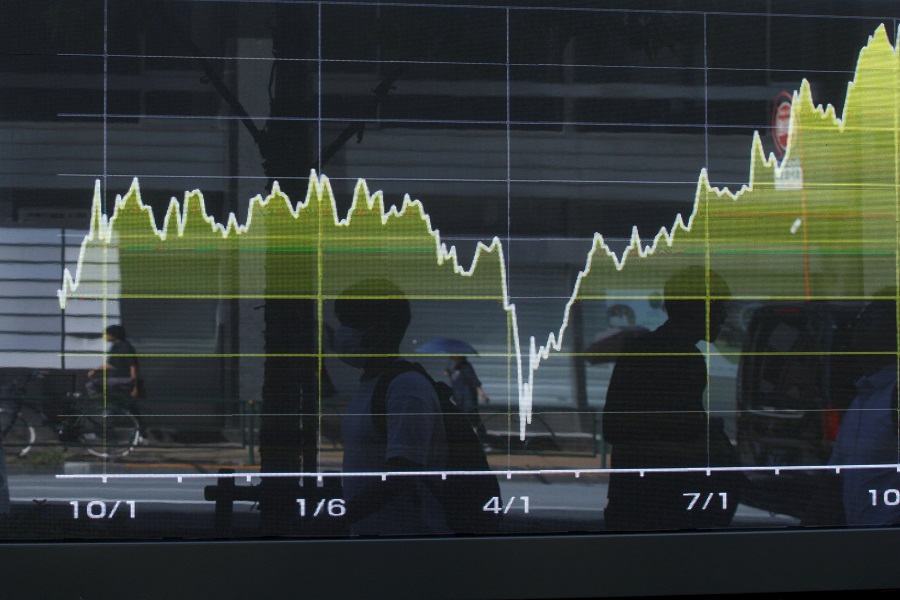

Opening Bell : Markets likely to make negative start amid weak global cues

Indian markets are likely to make a negative start on Wednesday amid weak global cues, following two strong sessions supported by relief over eased U.S. trade measures. However, some support may come later in the day with foreign investors turning net buyers. Overall, investors likely to remain cautious, with focus firmly on corporate earnings and global developments.

Some of the key factors to be watched:

Retail inflation dips in March: Retail inflation dipped marginally to a nearly six-year low of 3.34 per cent in March due to decline in prices of vegetables, eggs and protein-rich items, raising hope for a third rate cut by the RBI as it remains below the median target of 4 per cent.

IMD forecasts above normal monsoon in 2025: The India Meteorological Department (IMD) has predicted an above normal monsoon in 2025, which quantitatively could be 105 per cent of the Long Period Average (LPA).

India, US set to begin in-person negotiations for BTA: India and the US are set to begin in-person negotiations next month for a bilateral trade agreement (BTA), aiming to significantly boost trade. Virtual talks are commencing this week, with both nations finalizing the terms of reference for the pact.

India's trade deficit widens in March 2025: India's trade deficit increased sharply in March 2025 to $3.63 billion, as against $1.92 billion in the same month of 2024.

Govt forms group to monitor potential import surges: Commerce ministry said that the Indian government has established an inter-ministerial group to monitor potential import surges due to global trade tensions and high tariffs on countries like China and Vietnam. This move aims to prevent the diversion of goods to India and address concerns about increased inflow of US agricultural products.

On the global front: The US markets ended in red on Tuesday as traders were cautious with Labor Department stated that import prices slipped by 0.1 percent in March after rising by a downwardly revised 0.2 percent in February. Asian markets are trading mostly in red on Wednesday as investors watched the latest headlines on the tariff front.

Back home, Indian equity benchmarks ended on strong note on Tuesday, tracking a rally in global markets after US President Donald Trump relaxed some of the tariffs on electronics products and hinted at duty revision for automobiles. Finally, the BSE Sensex rose 1577.63 points or 2.10% to 76,734.89, and the CNX Nifty was up by 500.00 points or 2.19% to 23,328.55.

Some of the important factors in trade:

Wholesale inflation eases to 2.05% in March: The wholesale price index (WPI) based inflation eased to 2.05 per cent in March, as against 2.38 per cent in February. The WPI based inflation, however, rose year-on-year. It was 0.26 per cent in March 2024.

US curbs on Chinese goods open export window for Indian e-sellers: GTRI said the US tightening of low-value e-commerce shipments from China has opened up huge opportunities for Indian online exporters, as they can fill the gap if the red tape is eased and the government provides timely support.

Reciprocal tariffs by US to impact only 0.1% of Indian GDP: Exuding confidence in price competitiveness and continued government support, PHD Chamber of Commerce and Industry (PHDCCI) said that the reciprocal tariffs imposed by US President Donald Trump will impact only 0.1 per cent of the Indian GDP.

Above views are of the author and not of the website kindly read disclaimer