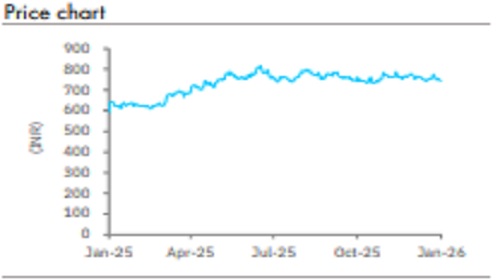

Buy HDFC Life Insurance Ltd for Target Rs 890 by Elara Capitals

Soft quarter as margins contract

HDFC Life Insurance (HDFCLIFE IN) posted Q3FY26 results with APE growth of ~11% YoY (versus industry ~10%), led by strong protection volume momentum post GST exemption and sustained ULIP demand amid favorable equities. Bancassurance, however, remained softer (9M growth ~2%), hit by rising competitive intensity and aggressive open -architecture pricing in the multi -insurer banca channel. Management sees this as temporary (HDFC Bank ’s wallet share is maintained). VNB margin contracted to 24.0% in Q3, mainly due to ongoing GST headwind, while better product mix offset some impact. EV stood at INR 615bn with operating RoEV of 15.6%, impacted by negative operating variance (~INR 700mn, la rgely persistency -driven) . F urther negative EV variance is expected from cohort -specific 13th - month persistency stress (down 200bps; early -bucket non -par impact). We upgrade to BUY.

GST impact expected to reduce going forward: HDFCLIFE is confident of neutralizing GST headwinds, having cut the impact to <200bps in Q3 (from ~300bps initially) through distributor negotiations, a shift to higher -margin protection, and product -level margin expansion . Further mitigation is expected in Q4 (targeting ~100bps impact) via operating leverage and sustained mix tailwinds, with VNB margin seen normalizing to mid -25% by FY27 E . Though the protection segment has seen tailwinds and pent -up demand due t o the addition of new customers, the durability of protection growth will be contingent on: a) pricing by reinsurance amidst a sharp rise in underwriting by the industry; and b) pricing and competitive intensity pressures among peers.

Margin protection preferred over aggressive volume: Management remains focused on underwriting discipline and profitable growth over chasing volumes, especially in multi - insurer bancassurance , where HDFCLIFE has tactically avoided irrational pricing and lower - quality business amid rising open -architecture competition. While this calibrated approach supports margin protection and long -term value creation (rising VNB wallet share at key partners), it may lead to slightly lower toplin e growth in the near -to me dium -term. We expect an APE CAGR of ~14.2% in FY26E -28E.

Presence deepening in tier-3 markets: HDFCLIFE is strengthening its long -term growth engine through investments in proprietary channels and deeper reach in tier -3 markets, driving broad -based expansion across cities. The agency channel grew in double -digits with >80,000 agent additions, and the branch network crossed 700 outlets. As this infrastructure matures, it should lift productivity and profitability, offset near -term banca softness, and support a more diversified and resilient growth profile.

Upgrade to Buy; TP maintained at INR 890: We upgrade HDF CLIFE to BUY (from Accumulate), as valuations now appear reasonable given that the stock has remained range bound, while franchise value and business economics appear unchanged. We maintain our TP at INR 890 , as we roll forward by a quarter. Our TP is based on 2.4x Dec -27E P/EV (12.5% cost of capital, 5% terminal growth) and an EV per share of INR 3 80. Our estimates are broadly unchanged .

Please refer disclaimer at Report

SEBI Registration number is INH000000933