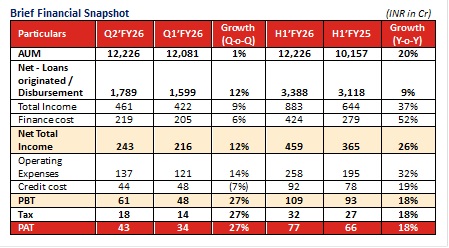

UGRO Capital reports 20% AUM growth in Q2FY26; strong asset quality and Emerging Market scale-up drive performance

UGRO Capital Limited, a DataTech NBFC focused on MSME lending, announced its financial results for the quarter and half-year ended September 30, 2025. Over the past three years, UGRO has consistently added approximately INR 3,000 crore to its AUM annually. With the proposed acquisition of Profectus Capital expected to contribute an additional INR 3,000 crore inorganically this year, the Company recalibrated its disbursal volumes to optimise liability requirements and moderate future borrowing costs. Following signs of over-leverage in parts of the unsecured segment, UGRO has curtailed throughput rates from 30% to 20% and tightened underwriting filters. This prudent approach aligns with the prevailing macro headwinds in the small-ticket MSME segment.

Emerging Market (EM) Business: Poised for Steady-State Profitability

UGRO’s Emerging Market (EM) (Small ticket Loan Against Property for Micro Enterprises) business continues to be a key growth driver, with 303 branches across 13 states and AUM of INR 2,997 crore, contributing 25% of total AUM. 29 branches have already reached INR 1 crore+ monthly productivity, generating stable profits. 86 branches are expected to mature within 12 months, and 188 branches within 18 months. With the physical network build-out complete, UGRO’s focus has shifted from expansion to branch-level productivity, risk calibration, and profitability improvement, establishing the foundation for long-term operating leverage.

Embedded Finance (MSL Platform): Scaling through Digital Ecosystems

UGRO’s embedded finance business through its MyShubhLife (MSL) platform continues to gain strong momentum. AUM reached INR 1,270 crore within four quarters, serving 1.5 lakh+ small retailers. Q2’FY26 disbursements stood at INR 713 crore, with a healthy monthly run rate of INR 200 crore. The platform addresses a $20+ billion credit gap in small retail and micro-merchant segments.

Capital and Liability Strengthening

UGRO raised INR 535 crore of equity capital which would be utilized for acquisition of Profectus Capital. Total borrowings rose to INR 8,088 crore, with cost of borrowing improving to 10.37% (-38 bps YoY). The Company’s off-book portfolio of 43% underscores its leadership in co-lending and securitisation partnerships, further diversifying its funding mix. Post this capital raise UGRO Net Worth is INR 2,463 crore with on balance sheet asset of INR 10,779 crore with debt to equity at 3.3x giving it head room for future growth.

Commenting on the results, Mr. Shachindra Nath, Founder and Managing Director of UGRO Capital said, “Q2’FY26 marked a period of strategic recalibration and operational steadiness. With the Emerging Market network now at 303 branches and the Embedded Finance platform scaling rapidly, UGRO is entering a phase of structural profitability improvement. Our portfolio quality remains robust, with 93% assets in Stage-1, 100% total collection efficiency, and conservative provisioning. As our branches mature over the next six quarters and Embedded Finance deepens, we see a clear pathway to ROA expansion and sustained value creation. The Profectus Capital acquisition and continued investment in our DataTech underwriting architecture strengthen UGRO’s position as India’s most diversified and data-driven MSME lender.”

Above views are of the author and not of the website kindly read disclaimer