The Alternate Opinion : Global Liquidity Tracker: Momentum in US ETF flows fading after 2-years. India Midcap flows showing recovery led by Japan funds by Elara Capital

Momentum in US ETF flows fading after 2-years. India Midcap flows showing recovery led by Japan funds

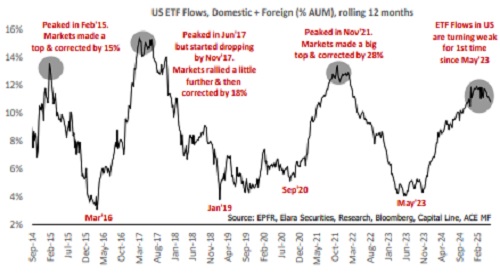

Domestic fund flows in the US continued to remain negative, with another $8.2bn in redemptions this week. Since mid-March, US domestic funds have seen outflows in 9 of the past 11 weeks, totaling $30.8bn. In contrast, foreign fund flows into the US, after a brief dip ($800mn outflow), turned positive again with $1.8bn of inflows this week. Most foreign inflows into US are primarily from Japan, UK, and Canada-based funds. Overall, the US flow trend is showing its first signs of weakness since May’23. On a one-year rolling basis, inflows into US ETFs (Domestic+Foreign) are beginning to slow. Similar patterns in Feb’15, Nov’17, and Nov’21 were followed by market correction.

EMs continue to attract inflows for the 7 th consecutive week across most regions. This week’s strongest foreign inflows were recorded in S.Korea ($508mn), India ($229mn), Brazil ($123mn) and Mexico ($101mn). Both Brazil and Mexico have consistently attracted foreign capital since the beginning of this year.

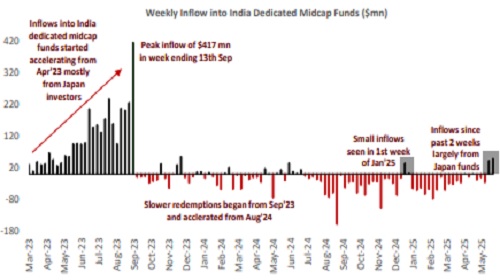

India saw another $229mn in net inflows this week, up from $159mn the previous week. India-focused funds have now seen inflows for eight consecutive weeks, with $136mn added this week versus $102mn the prior week. Notably, India-dedicated Midcap funds—which had faced consistent redemptions since Jan’25—are now seeing demand, particularly from Japan-based investors. Over the past two weeks, India Midcap funds have garnered $91mn in inflows. Meanwhile, Large Cap inflows remain concentrated in ETFs.

Gold funds recorded another strong week with $4.5bn in inflows, following $4bn the prior week. After a brief pause in May 2025, interest in Gold funds has resumed. Junk bond funds also remain popular, posting a sixth consecutive week of inflows—$2.8bn this week, after $2bn the previous week.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

Tag News

SBI Mutual Fund announces the launch of SBI Quality Fund