SUMMARY: Equity inflows witness a slowdown; Automobiles hog the limelight by Motilal Oswal Financial Services Ltd

Key observations

The Nifty ended 1.4% lower MoM at 24,427 in Aug’25 – the second consecutive month of a decline. Notably, with extreme volatility, the index hovered ~816 points before closing 342 points lower. In Aug’25, DIIs posted the second-highest ever inflows at USD10.8b following a record high in Oct’24. FIIs recorded the second consecutive month of outflows at USD4.3b. FII outflows from Indian equities reached USD15.1b in CY25YTD vs. outflows of USD0.8b in CY24. DII inflows into equities remained robust at USD62.3b in CY25YTD vs. USD62.9b in CY24.

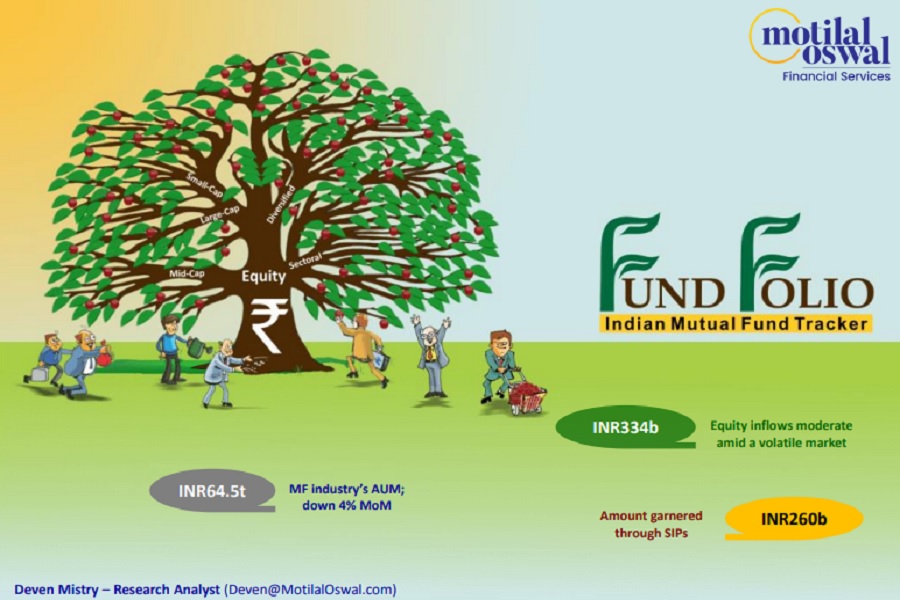

Total AUM of the MF industry, after scaling new highs in Jul’25 (INR75.4t), declined marginally in Aug’25 to INR75.2t (-0.2% MoM), primarily led by a MoM dip in AUM for equity (-INR209b), liquid (-INR70b), other ETF (-INR22b), and Gilt (-INR16b) funds. Conversely, AUM of Gold ETFs increased INR49b, income funds rose INR36b, balanced funds grew INR25b, and arbitrage funds increased INR22b MoM.

Equity AUM for domestic MFs (including ELSS and index funds) declined 0.6% MoM to INR36.2t in Aug’25, led by a decline in market indices (with Nifty declining 1.4% MoM) and a decrease in sales of equity schemes (down 18.5% MoM to INR687b). The pace of redemptions slowed down to INR338b (down 14.1% MoM). Consequently, net inflows moderated in Aug’25 to INR349b from INR450b in Jul’25.

Investors continued to park their money in mutual funds as inflows and contributions in systematic investment plans (SIPs) stood at INR282.7b in Aug’25 (-0.7% MoM and +20% YoY).

A few interesting facts

* The month witnessed notable changes in the sector and stock allocation of funds. On an MoM basis, the weights of Automobiles, Technology, Consumer, Telecom, Retail, and Media increased, while those of Private Banks, Healthcare, Capital Goods, Oil & Gas, Chemicals, and Real Estate moderated.

* Automobile’s weight climbed for the second consecutive month to a 10-month high in Aug’25 to reach 8.5% (+50bp MoM; -10bp YoY).

* Technology’s weight inched up in Aug’25 to 7.9% (+10bp MoM; -130bp YoY) after slipping to a 14-month low in Jul’25 to 7.8%.

* Private Banks’ weight slipped to a seven-month low in Aug’25 to 17.5% (-50bp MoM; +160bp YoY).

* Healthcare's weight, after touching a seven-month high in Jul’25, moderated in Aug’25 to 7.6% (-20bp MoM; +20bp YoY).

* The top sectors where MF ownership vs. the BSE 200 is at least 1% higher: Healthcare (16 funds over-owned), Chemicals (11 funds over-owned), Consumer Durables (11 funds over-owned), Capital Goods (9 funds over-owned), and Retail (8 funds over-owned).

* The top sectors where MF ownership vs. the BSE 200 is at least 1% lower: Consumer (18 funds under-owned), Oil & Gas (17 funds under-owned), Private Banks (16 funds under-owned), Utilities (12 funds under-owned), and Technology (10 funds under-owned).

* In terms of value increase MoM, divergent interests were visible within sectors: The top 5 stocks that witnessed the maximum rise in value were Maruti Suzuki (+INR87.2b), Eternal (+INR86.5b), TVS Motor (+INR32.9b), Infosys (+INR29.4b), and Adani Energy Solutions (+INR26.1b).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...