Fund Folio - April 2025 by Motilal Oswal Financial Services

Key observations

The Nifty, after five consecutive months of decline, bounced back smartly in Mar’25 with a 6.3% MoM gain – the highest since Jul’24. During FY25, midcaps gained 7%, outperforming largecaps and smallcaps, which rose 5% each. Mar’25 recorded FII inflows after two consecutive months of outflows. FII inflows stood at USD0.2b in Mar’25 after outflows of USD5.4b/USD8.4b in Feb/Jan’25. Conversely, domestic inflows moderated to USD4.3b in Mar’25 from USD7.4b/USD10.0b in Feb/Jan’25.

However, despite the challenges, domestic MFs saw their equity AUM rise for the fifth consecutive year to INR32.3t (+26% YoY) in FY25. AUM growth was fueled by an uptrend in market indices (Nifty: +5% YoY) and higher sales of equity schemes (at INR9,396b; +65% YoY). However, redemptions also rose 25% YoY to INR4,636b, leading to a rise in net inflows (more than double YoY) to INR4,760b in FY25 (all-time high) from INR1,971b in FY24.

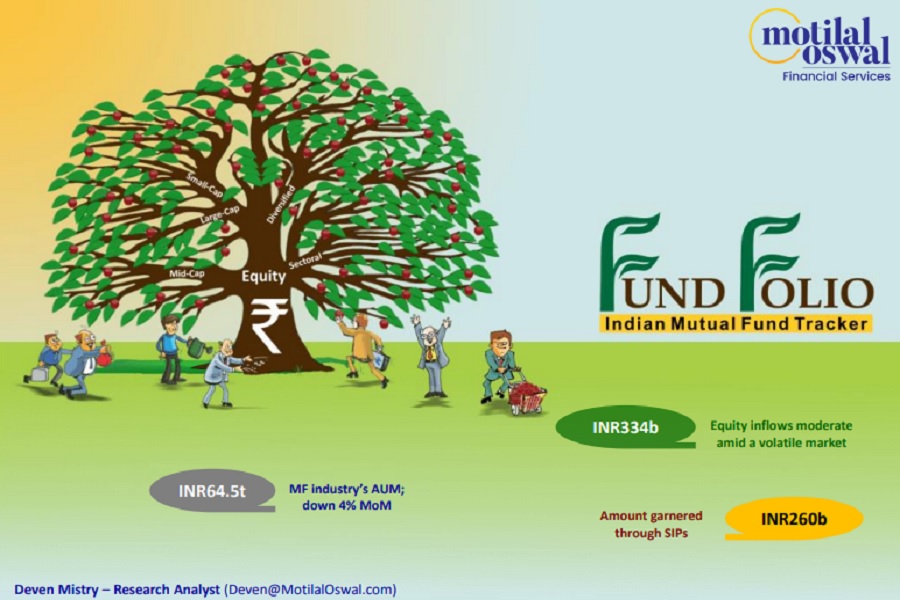

The MF industry’s total AUM increased 23% YoY (INR12.3t) to INR65.7t in FY25, propelled by the growth in equity funds (INR6,660b), liquid funds (INR1,580b), other ETFs funds (INR1,156b), balanced funds (INR1,096b), and income funds (INR933b).

Investors continued to park their money in mutual funds as inflows and contributions in systematic investment plans (SIPs) stood at INR259.3b in Mar’25 (-0.3% MoM and +34.5% YoY).

A few interesting facts

* The year saw a notable change in the sector and stock allocation of funds. The weight of defensives improved 30bp to 29.7%, aided by an increase in the weights of Telecom and Healthcare, while the weights of Consumer, Technology, and Utilities moderated (refer to page 4 for detailed charts).

* The weight of Domestic Cyclicals too increased 30bp to 61.5%, led by Banks-Private, Retail, Insurance, Real Estate, Infrastructure, and Cement.

* Global Cyclicals’ weightage declined 70bp to 8.7%, dragged down by Oil & Gas.

* Healthcare saw a rise in weight to 7.6% (+20bp YoY) in FY25, improving its position to fourth from fifth a year ago.

* Technology’s position remained unchanged over the last one year, while its weightage declined by 20bp YoY to 8.5%.

* Private Banks saw a surge in weight to 18.4% (+150bp YoY).

* PSU Banks witnessed a decline in weight to 2.8% (-60bp YoY).

* Capital Goods saw a decrease in weight to 7.2% (+70bp YoY).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...