Fund Folio : Equity AUM rises for 11 successive years, net inflows more than double in CY24 By Motilal Oswal Financial Services Ltd

Equity AUM rises for 11 successive years, net inflows more than double in CY24

Key observations

* Indian markets celebrated another year of gains in CY24, marking a historic milestone with nine consecutive years of returns! Both the global and Indian markets faced significant challenges in CY24, including geopolitical headwinds, regulatory tightening, a strengthening USD, persistent inflation, high interest rates, a consumption slowdown, earnings moderation, valuation concerns, and volatile FII flows, leading to heightened market volatilities. DII flows into equities were the highest ever at USD62.9b in CY24 vs. inflows of USD22.3b in CY23. Conversely, FII outflows stood at USD0.8b in CY24 vs. inflows of USD21.4b in CY23.

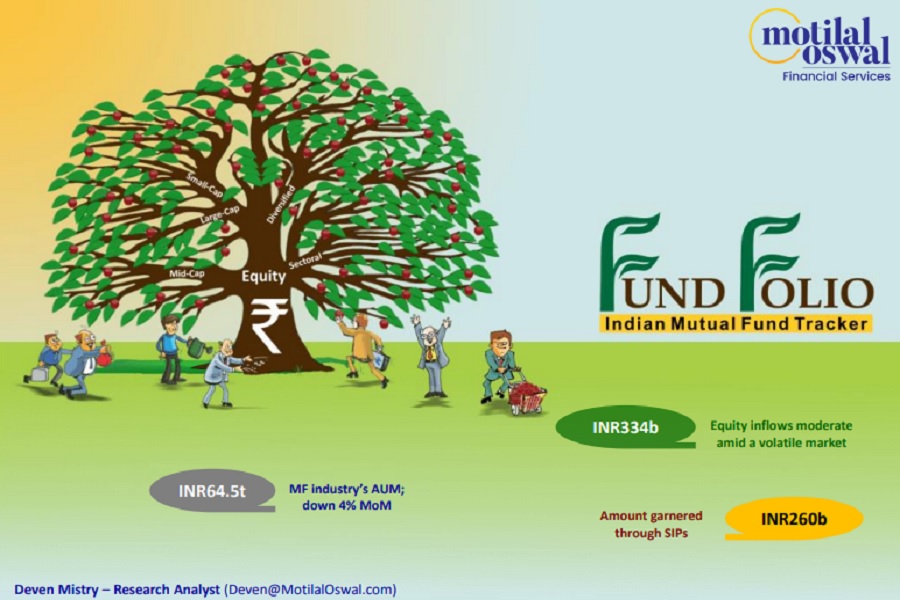

* However, despite the challenges, domestic MFs saw their equity AUM rise for the 11th consecutive year to INR33.4t (+40% YoY) in CY24. AUM growth was fueled by an uptrend in market indices (Nifty: +9% YoY) and higher equity scheme sales (at INR9,120b; +69% YoY). However, redemptions also rose 40% YoY to INR4,645b, leading to a rise in net inflows (more than double YoY) to INR4,475b in CY24 (all-time high) from INR2,063b in CY23.

* The MF industry’s total AUM increased 32% YoY (INR16.1t) to INR66.9t in CY24, propelled by the growth in equity funds (INR9,537b), liquid funds (INR1,727b), balanced funds (INR1,533b), other ETFs funds (INR1,424b), and income funds (INR954b).

* Investors continued to park their money in mutual funds, with inflows and contributions in systematic investment plans (SIPs) reaching a new high of INR264.6b in Dec’24 (up 4.5% MoM and 50.2% YoY).

Some interesting facts

* The year saw a notable change in the sector and stock allocation of funds. The weight of defensives improved 60bp to 30.3%, propelled by an increase in the weights of Healthcare and Telecom, while Consumer and Utilities moderated (refer to page 4 for detailed charts).

* The weight of Domestic Cyclicals declined 40bp to 61.5%, pulled down by BFSI, Chemicals, Media, Cement, and Textiles.

* Global Cyclicals’ weightage, too, decreased 30bp to 8.2%, dragged down by Oil & Gas and Metals.

* Healthcare saw a rise in weight to 7.8% (+80bp YoY) in CY24 - improving its position to fourth from fifth a year ago.

* The BFSI pack, however, saw a massive 250bp contraction in weight to 26.5%.

* Technology’s position remained unchanged over the last one year, with the weightage remaining flat at 9.4%.

* Consumer witnessed a decline in weight to 6% (-40bp YoY).

* Capital Goods saw a rise in weight to 7.8% (+40bp YoY).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Invesco Asset Management (India) announces change to OPA