Fund Folio report by Motilal Oswal Financial Services Ltd

Key observations

* The Nifty slid 5.9% MoM in Feb’25, closing in the red for the fifth consecutive month and recording the second steepest MoM decline since Mar’20. This market correction has coincided with a slowdown in earnings growth, concerns over global economic growth due to the tariff war, and FII outflows. FIIs recorded outflows for the second consecutive month, with outflows of USD5.4b in Feb’25 following USD8.4b of outflows in Jan’25. Conversely, domestic inflows remained strong at USD7.4b in Feb’25 vs. inflows of USD10b in Jan’25.

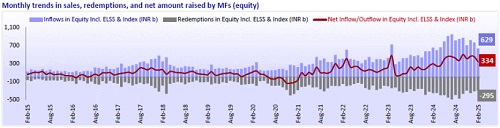

* Equity AUM of domestic MFs (including ELSS and index funds) decreased 6.7% MoM to INR30.1t in Feb’25, led by a fall in market indices (Nifty down 5.9% MoM). Notably, the month saw a decrease in sales of equity schemes (down 17.4% MoM to INR629b). The pace of redemptions slowed down to INR295b (down 5.7% MoM). Consequently, net inflows moderated to a 10-month low in Feb’25 to reach INR334b vs. INR449b in Jan’25.

*Total AUM of the MF industry declined 4% MoM to INR64.5t in Feb’25, primarily owing to a MoM dip in AUM of equity funds (INR2,150b), other ETFs (INR360b), and balanced funds (INR236b). Conversely, AUM of liquid funds increased INR63b MoM.

* Investors continued to park their money in mutual funds, with inflows and contributions in systematic investment plans (SIPs) at INR260b in Feb’25 (-1.5% MoM and +35.5% YoY).

A few interesting facts

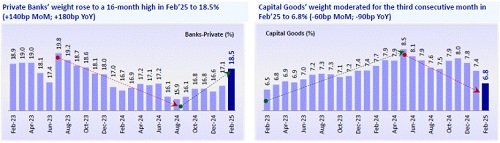

* The month experienced notable changes in the sector and stock allocation of funds. On a MoM basis, the weights of Private Banks, NBFCs, Healthcare, Telecom, and Metals increased, while those of Capital Goods, Technology, Automobiles, Consumer, Oil & Gas, Utilities, PSU Banks, Retail, and Infrastructure moderated.

* Private Banks’ weight rose to a 16-month high in Feb’25 to 18.5% (+140bp MoM; +180bp YoY)

* Capital Goods’ weight moderated for the third consecutive month in Feb’25 to 6.8% (-60bp MoM; -90bp YoY)

* Technology’s weight moderated in Feb’25 to 9.3% (-30bp MoM; -20bp YoY)

* Automobiles’ weight touched a 19-month low in Feb’25 to 8.1% (-30bp MoM, -10bp YoY)

* In terms of value increase MoM, six of the top-10 stocks were from the BFSI space: HDFC Bank (+INR110.1b), Axis Bank (+INR48.3b), Kotak Mahindra Bank (+INR18.9b), Bajaj Finance (+INR17.9b), Bajaj Finserv (+INR13b), and Shriram Finance (+INR6.4b).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412