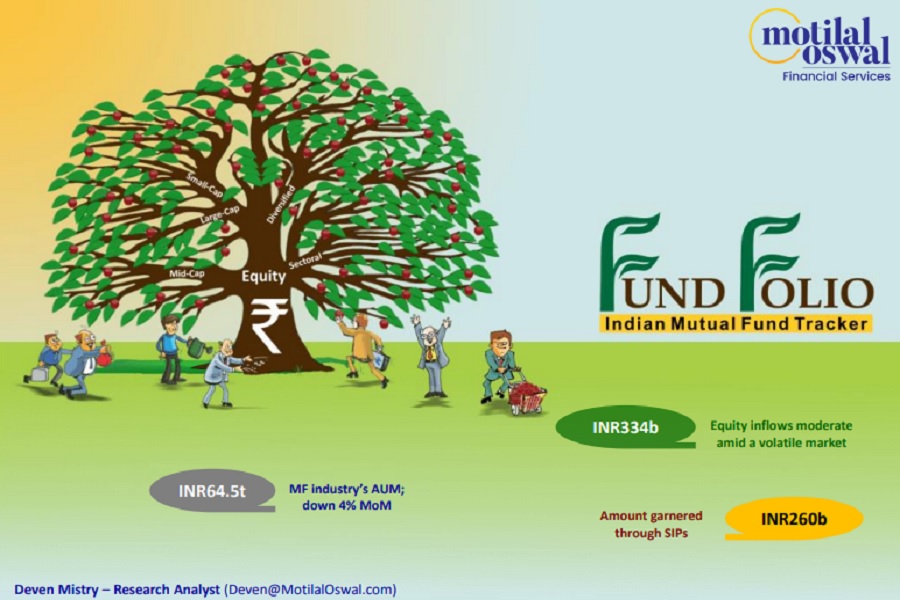

Mistakes Investors Make: Chasing Performance vs Staying Invested

One of the most common mistakes investors make is chasing past performance instead of staying invested with a disciplined approach. The Alpha Strategist - February 2025 report by Motilal Oswal Wealth Ltd. highlights how frequent switching between investments can reduce returns and increase risk exposure, making long-term investing the superior strategy.

Key Market Insights (Source: Alpha Strategist - February 2025, Motilal Oswal Wealth Ltd.)

1. Why Chasing Performance Often Leads to Poor Returns

Investors tend to buy high and sell low, entering funds or stocks after a rally and exiting during corrections.

The Alpha Strategist report highlights that “funds that performed the best in the past 1-2 years rarely sustain their outperformance over the next cycle.”

2. Data on 3-Year Rolling Returns and Market Cycles

The report analyzed historical 3-year rolling returns across equity mutual funds and found that funds with recent high returns tend to underperform in subsequent years.

“Investors who constantly switch funds in search of better returns lose out due to exit loads, taxation, and reallocation timing issues,” the report notes.

3. How to Stick to an Investment Plan with Discipline

Investing based on a long-term financial goal rather than short-term performance trends leads to higher wealth creation.

The Alpha Strategist report suggests that Systematic Investment Plans (SIPs) and asset allocation strategies are more effective than timing the market.

“A structured portfolio review every 6-12 months, rather than impulsive decisions based on past returns, leads to better results,” states the report.

Investment Strategy (Based on the Report’s Recommendations):

* Avoid Chasing Short-Term Returns: Stick to a long-term investment horizon.

* Follow a Structured Review Process: Rebalance portfolios periodically, not impulsively.

* Invest in Funds Based on Fundamentals: Choose investments based on quality, not recent performance.

* Stay Invested in Market Corrections: Use SIPs to benefit from market volatility.

Final Takeaway:

The Alpha Strategist - February 2025 report by Motilal Oswal Wealth Ltd. strongly advises investors to avoid switching funds frequently and stay committed to their investment plans. Chasing past performance often leads to underperformance and additional costs, whereas staying invested in quality funds with a disciplined approach leads to superior wealth creation.

To Read Complete Report in Detail : Click Here

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412