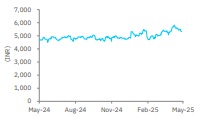

Sell Eicher Motors Ltd for Target Rs.4,603 by Elara Capitals

Margins disappoint yet again

Eicher Motors’ (EIM IN) consolidated revenue touched a life-time high of INR 52.4bn in Q4, mainly led by a strong 24.2% YoY growth in volume. Despite robust volume growth, EBITDA growth was just 9% YoY as gross margin contracted 90bps QoQ. This was mainly due to: a) unfavorable product mix (30bps), b) commodity cost (20bps) and c) provisioning for older models (20bps). EBITDA margin came in weak at 24% in Q4 (expectations at 25.2%), on weaker mix and higher other expense. Increase in other expense included liquidationrelated expense of INR 190mn in the European market.

In Q4, Royal Enfield’s (RE) volume grew 24% YoY and EBITDA 9%. TVS, with a 15% volume growth, delivered a 21% EBITDA (ex of PLI). Even Hero, with a 1% YoY contraction in volume, delivered an EBITDA growth of 4% YoY, marginally lower than EIM’s 9% EBITDA growth. We tweak our FY26E-27E earnings estimates by 1-2%, and maintain SELL. We lower our TP to INR 4,603, on 25x June 2027E P/E for RE and 10x EV/ EBITDA for VECV, as we roll forward.

Growth in profitability compromised; EBITDA per vehicle down to eight-quarter low: Despite all-time high volume in Q4FY25 for RE, EBITDA per vehicle slumped to an eightquarter low of INR 44,581 and gross profit per vehicle was at the lowest in past seven quarters. Also, the so-called one-off expense in Q3 (which we view more as bulky than one off) did not provide any relief to the QoQ margins.

Margin subdued on weak mix and higher other expense: EIM has now maintained that it will focus on absolute growth of profitability rather than percent margins. Hence in an attempt to boost volumes, we believe there could be further downside risk to percent margins, though we have not yet factored that. EIM hiked price in the range of 1-1.5% led by increased cost due to on-board diagnostics (OBD) and compliance of emission norms. EIM has guided for capex of INR 13bn in FY26E.

Maintain Sell with a lower TP of INR 4,603: We factor in a total monthly volume run-rate of 91k through FY26E, and EBITDA per vehicle at INR 46k (INR 45k in Q4 on reported numbers). Despite this, our FY26E and FY27E consolidated EPS is ~5% and 11% below consensus respectively and we see downside risks to consensus estimates. Maintain SELL on EIM. We lower our TP to INR 4,603 from INR 4,736 owing to earnings cuts of ~2%.

Historically, EIM has commanded a premium multiple versus other 2W players, owing to its pricing power and ability to outgrow the industry, both on volumes and profits. However, in our view the quality of volume growth coming for EIM in the past 6-8 months continues to be weak and hence, does not deserve multiples closer to historical levels. This kind of volume growth is ‘discounted pricing’ volume growth (mainly led by price cuts for the Bullet variant) and not due to success of new launches. While management’s decision to focus on volumes is justified in our view given last few years stress on demand, we believe investors are over-rewarding this decision in terms of valuation to the company closer to historical levels. While RE may outperform in volume growth in the next six months owing to a low base, sustaining this in FY26E/27E and significant EBITDA/ PAT growth outperformance versus peers are unlikely.

Please refer disclaimer at Report

SEBI Registration number is INH000000933