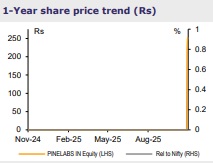

Reduce Pine Labs Ltd for the Target Rs.210 By Emkay Global Financial Services Ltd

Stiffening competitive pressure; initiate with REDUCE

We initiate coverage on Pine Labs with REDUCE and TP of Rs210. Pine Labs has a strong value proposition in the enterprise POS segment (supported by high customer stickiness driven by deep software integration) and dominant position in EMI aggregation (owing to its early-mover advantage). However, we expect competitive intensity to rise across both segments, as adjacent-market players are increasingly targeting these pools. In merchant acquisition, industry growth is being led by digitization of small merchants, for whom low-end devices and strong distribution capabilities are crucial success factors. While Pine Labs is ramping up shipments of low-end Mosambee devices, its distribution is still weaker than peers’, limiting its right-to-win in this segment. Its India gift-card business is profitable albeit growth-constrained, while its international business is scaling up rapidly although it operates at low and volatile margins. We model 19% revenue CAGR for FY25-28E which translates into 53% EBITDA CAGR on a low base. On FY28 estimates, the stock trades at 28.1x EV/EBITDA and 56.4x P/E. Given the rising competition, we see an unfavorable risk-reward.

Leadership in enterprise POS business seeing increased competition

Pine Labs has been shifting its device mix toward low-cost, non-Android terminals, driving a decline in capex-to-sales, to 6.6% in FY25 from 35%/26% in FY22/FY23. While this supports higher free cash flow, we expect ARPU pressure to persist, with subscription revenue CAGR at only 9.9% over FY25–28E. We estimate a modest 18.8% revenue CAGR for the Digital Infrastructure and Transaction Processing (DITP) business over FY25–28E, on increasing competition in the enterprise POS (point-of-sale) segment and India’s payment acceptance landscape migrating toward QR-based solutions.

Gift-card business monetization driven by interest income on consumer funds

The gift-card ecosystem comprises the brand, PPI issuer, distributor, end-consumer, and merchant (brand-owned stores or online platforms). Pine Labs primarily functions as the PPI issuer, enabling brands to design, distribute, and manage gift cards across multiple channels. Monetization is skewed toward interest income earned on customer float (67bps in FY25), which is higher than the commission income derived from brands (63bps in FY25). Growth in the gift card business is fueled by the international business (192% CAGR over FY22-9MFY25, annualized) with volatile margins (ranging from 0.5-56.3% during FY22–9MFY25) while India growth is muted (13.4% CAGR).

Outlook and Valuations – Premium valuations amid rising competition

We believe Pine Labs faces two structural headwinds: the accelerating shift toward a QRbased acceptance ecosystem and the rising competitive intensity in merchant acquisition. At current valuations, Pine Labs trades at 28.1x FY28E EV/EBITDA and 56.4x P/E. Given its weaker competitive position vs peers, the maturing nature of its core enterprise POS business and ongoing market-share losses across both POS and affordability, we view risk-reward as unfavorable. We initiate coverage on Pine Labs with REDUCE and DCFbased TP of Rs210, implying a FY28E EV/EBITDA multiple of 24.2x.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354