Reduce Coal India Ltd for the Target Rs.401 by JM Financial Services Ltd.

Coal India reported consolidated net revenue of INR 349bn (-5% YoY, 1% JMFe, 3% consensus) due to moderation in offtake to 188MT (194MT in 3QFY25). Post a one-off pay scale revision adjustment of INR 22bn, adjusted EBITDA was INR 115bn (-6% YoY, 15% JMFe, 14% consensus) driven by lower cost of material, which lifted EBITDA/t to 615 (JMFe: 533). Adjusted PAT was INR 88bn (4% YoY, 26% JMFe, 23% Consensus) due to lower depreciation (-12% YoY) and higher other income (12% YoY). E-auction realisation moderated to INR 2,435/t (-9% YoY). We revise our CIL production estimate to 770MT (820MT earlier) versus target of 875MT, given the current pace of production (-4% YoY)/ offtake (-1% YoY). We foresee structural and gradual decline in utilisation of thermal power plants during solar hours, constraining the growth potential for coal (Once there was a king; Downgrade to HOLD). We maintain REDUCE with a TP of INR 401 implying 4.3x EV/EBITDA FY28

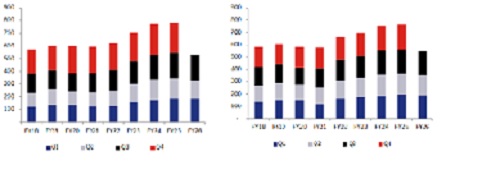

? Operational highlights: Coal production was flat (-1% YoY) at 200MT in 3QFY26 versus target of 229MT. Production at CIL’s major subsidiaries BCCL/ SECL/ MCL/ NCL/ CCL grew -11%/ 16%/ -2%/ -6%/ -3% YoY. Coal dispatches were down by 3% YoY to 189MT during 3QFY26 versus target of 235M. Blended realisation was INR 1,642/t (INR 1,664/t in 3QFY25). Average FSA realisation was INR 1,505/t (5% YoY, 2% QoQ) whereas average e-auction realisation moderated to INR 2,435/t (-9% YoY, 6% QoQ). Coal India has an aspiration to reach 1bn tonnes (BT) of production by FY27, which we believe will now happen by FY30.

? Estimated production during FY26: Coal India has been given a target of producing 875MT during FY26. So far, it has produced 546MT (-3% YoY). Considering production of 529MT during 9MFY26 (543MT in 9MFY25), we estimate CIL will produce 770MT during FY26 versus our estimate of 820MT at the start of the year. Thermal generation grew 1.5% YoY in Jan’26.

? Moderation in coal and e-auction prices: Global coal prices have significantly corrected due to low demand for imported coal in China and India. HBA Index was down 16% YoY at USD 106/t. Indonesian Coal (5,900 GAR) / South African Coal (6000 GAR)/ Australian Coal (6000 GAR) prices stood averaged USD 79.5/t / USD 84.3/t / USD 104.7/t during 3QFY26, down 15%/ 22%/ 24% YoY.

? Power demand remains subdued: During the quarter, energy requirement was flat YoY at 392BU, resulting in 1% YoY fall in generation. Due to the extended monsoon and increase in renewable capacity, hydro / RE generation rose by 14%/ 21% YoY, while thermal generation fell by 5% YoY. Subdued thermal generation impacted coal PLF, which was 61% in 3QFY26 versus 64% in 3QFY25, and led to an increase in the company’s coal inventory to 90MT as of Dec’25 (70MT as of Dec’24).

? GST on coal: Prior to the recent increase in rates, coal attracted 5% GST and a compensation cess of INR 400/t. The cess is now merged with GST, effectively increasing the GST rate to 18%. This change is positive for Coal India, as the company has accumulated ITC of INR 170bn as of Mar’25, largely comprising GST paid on royalty for mining operations under the reverse charge mechanism (RCM) at 18%, against which recovery was earlier capped at 5%. With the rate hike, the inverted tax structure has been addressed, allowing Coal India to utilise this accumulated credit and improve cash flows. Elimination of inverted tax structure led to utilisation of accumulated ITC of INR 26bn in 3QFY26. (GST rate reduction: Good, but adds one more challenge.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361