Opening Bell: Markets likely to get cautious start tracking weakness across global markets

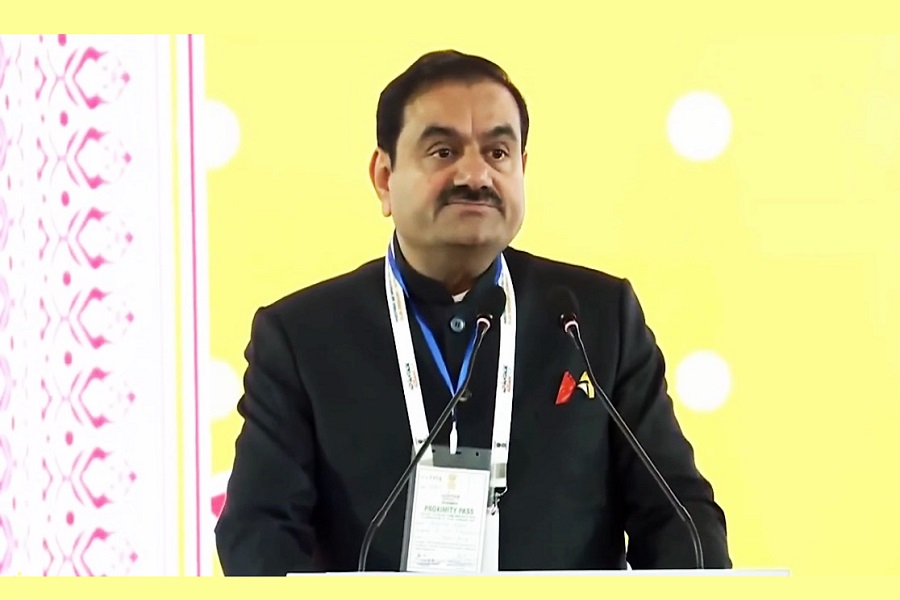

Indian markets continued their bull run and ended higher on Wednesday as a rally in Adani group, FMCG, IT, and PSU banks aided sentiment. Today, markets are likely to make a cautious start tracking weakness across global markets as investors await jobless claims numbers in the US. Investors will be closely watching the ongoing Reserve Bank of India’s December Policy meeting. While all eyes are on the announcements by Governor Shaktikanta Das on December 8. A private report expects the repo rate to remain unchanged and sees RBI maintaining a hawkish tone. Meanwhile, the government has sought parliamentary approval for an additional net spending of Rs 58,378 crore in the first batch of supplementary demand for grants in this financial year. However, a slump in crude oil prices can boost sentiment after a sharp fall in Brent to the lowest levels since June, on supply issues. Traders will be taking encouragement as Industry chamber CII expects the country's economy to grow at 6.8 per cent in the current fiscal and accelerate to 7 per cent in 2024-25, driven by the government's continued focus on infrastructure development and promotion of ease of doing business. Traders may take note of report that Fitch said supply chain diversification will help economies like India contribute more to global trade, as it projected nearshoring and friend-shoring to improve prospects for emerging market economies. Besides, to promote ease of doing business, capital markets regulator Sebi has decided to standardise the framework for calculation of available net distributable cash flows by REITs, InvITs and their respective holding companies. Banking stocks will be in focus after Moody's Investors Service issued a negative outlook for global banks in 2024, attributing the negativity to the repercussions of central banks' tightening of monetary policies. There will be some reaction in coal industry stocks as coal and power minister Pralhad Joshi said that the country's coal import has registered a drop of five per cent at 125.21 million tonnes (MT) in the April-September period of the ongoing financial year.

The US markets ended lower on Wednesday amid signs of a cooling jobs market reinforced expectations that the Federal Reserve could start cutting interest rates early next year. Asian markets are trading in red on Thursday ahead of Chinese trade figures due later in the day.

Back home, extending their winning streak to the seventh consecutive session, Indian equity benchmark ended at fresh record closing highs on Wednesday, driven by consistent buying from foreign institutional investors and a decline in crude oil prices. Foreign institutional investors purchased shares worth Rs 5,223.51 crore on Tuesday, according to exchange data. Markets made an optimistic start as traders took support with report that banks have written off Rs 10.57 lakh crore during the last five financial years, of which Rs 5.52 lakh crore was in respect of loans pertaining to large industries. The scheduled commercial banks have also recovered Rs 7.15 lakh crore of non-performing assets (NPAs) during the five-year period. Some support also came with the finance ministry’s statement that the Central government’s debt is estimated to moderate to 57.2% of gross domestic product (GDP) in FY24 from 61.5% in FY21 when pandemic-related spending to provide succour to people and businesses led to a spike in its loan profile. However, markets trimmed some gains in second half of trading session as some concern came with report that India's gross foreign direct investment (FDI) inflows dropped almost 16% in the first six months of FY24 from a year before to $33.12 billion, the second straight fall in the first half of a fiscal. The minister of state for finance Pankaj Chaudhary said the inflow have been impacted by the threat of global recession, economic crisis due to the Russia-Ukraine conflict, global protectionist measures and decline of real GDP growth rates of Singapore, USA and UK which are the major source countries for FDI. But, key indices regained traction in final hour of trade to end higher as some optimism remained among traders amid a private report stating that the Bharatiya Janata Party's (BJP) strong showing in the state elections has bolstered hopes of political stability at the Centre, alleviating investor concerns regarding political uncertainty in the months leading to the general elections next year, although some of them remain cautious about the potential impact of budget provisions on investor sentiment. Traders took a note of report that India and the UK have begun crunch-time talks to secure a landmark free-trade deal, as leaders on both sides seek to resolve outstanding issues before they face election battles next year. Finally, the BSE Sensex rose 357.59 points or 0.52% to 69,653.73 and the CNX Nifty was up by 82.60 points or 0.40% to 20,937.70.

Above views are of the author and not of the website kindly read disclaimer

More News

Market Watch : Nasdaq dives nearly 4% - Geojit Financial Services Ltd