The index traded range-bound during the first three session within 24500- 24200 - ICICI Direct

Nifty : 24008

Technical Outlook

Day that was…

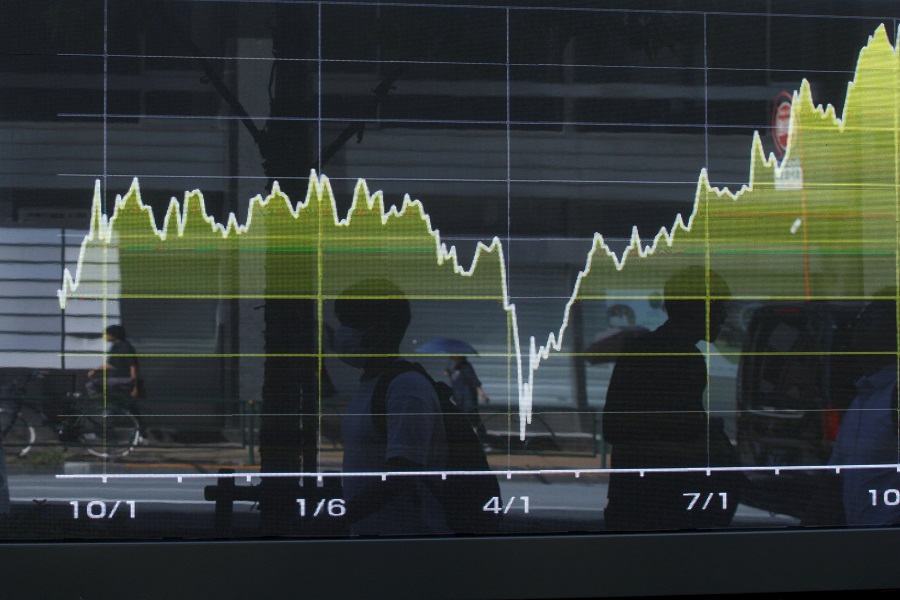

Indian equity benchmarks closed the week on a negative note amid an escalation of geopolitical tension. The index settled at 24008, down 1.39% for the week. Market breadth tilted in the favor of declines with an A/D ratio of 1:2, as broader market relatively underperformed. The Small cap index closed negative ~2% for the week. Sectorally, barring Auto, all indices closed in the red, with, Realty, PSY Bank and Nifty Bank being the laggards.

Technical Outlook

* The index traded range-bound during the first three session within 24500- 24200. However, the escalation of geopolitical tension on Thursday along with strengthening of dollar, where it pullback ~2.5% from the lows 83.76 resulted in a selloff making a lower-low-high formation on daily timeframe. As a result, the weekly price action resulted in a bear candle which engulfed previous weeks real body, India VIX closed the week above 21 levels for the first time since June 2024 which may result into heightened volatility and extended breather after recent rally.

* Nifty is expected to start the week with a gap up on de-escalation of geopolitical worries coupled with possible U.S. – China trade deal. We believe, the development of the domestic as well as global front would boost the market sentiment and drive index higher. We expect, Nifty to eventually challenge the upper band of consolidation placed at 24500 and head towards 25000 in coming weeks. A key point to highlight is that over the past three decades, index staged a strong rebound once the anxiety around the armed conflict settles down. In the current scenario, postceasefire announcement, we expect index to maintain the same rhythm and stage a strong recovery. Hence, any temporary breather should be utilized to accumulate quality stocks with strong earnings, as strong support is placed at 23,500. Our positive view is further validated by the following observations:

* a) Possibility of U.S. China trade deal would boost the market sentiment

* b) There is an ancient market saying: “Sell in May and go away.” However, historical data suggests that the Nifty has witnessed positive returns in 9 out of the last 12 years (2013–2024), with an average return of 2.1%.

* c) Elongation of rallies followed by shallow retracement in Bank Nifty highlights a robust price structure.

* d) The India-UK FTA deal is expected to bolster positive market sentiment.

* e) Cool off in Brent crude oil prices and weakness in US Dollar index would provide further cushion to domestic market.

* f) FIIs witnessed their buying streak for sixteen consecutive sessions (the longest in 2 years), accumulating a total of ~49,000 crores. The return of FIIs bodes well for Indian equities.

* g) Bilateral Trade Agreement between India and US would boost the market sentiment

* Amid heightened geopolitical worries we revise support base at 23500 zone as it is 50% retracement of recent rally (21743-24589)

Nifty Bank: 53595

Technical Outlook

Day that was…

The Bank Nifty witnessed volatile week amid escalation of geopolitical tension between India and Pakistan where it settled the week on a negative note at 53595 , down by 2 .76 % . The Nifty PSU Bank index underperformed the benchmark and settled at 6266 , down by 4 .39 % .

Technical Outlook :

* The Bank Nifty opened the week on a flat note and traded with a bearish bias throughout the week amid uncertainty due to escalation of geopolitical tension . The weekly price action resulted in a sizeable bear candle, indicating prolonged consolidation .

* Key point to highlight is that, the index is witnessing slower pace of retracement as it has retraced only 38 . 2 % in last 12 trading sessions of the sharp up -move seen in preceding 9 sessions . However, due to the escalation of geopolitical tension elongation of correction cannot be ruled out where the strong support is placed at 52000 which is swing high of previous months rally as well as 61 . 8 % retracement of the recent up -move (49156 -56098 ) . Hence, any decline from hereon would lead to higher base formation that would set the stage for next leg of up move .

* Structurally, the Bank Nifty is witnessing elongation of rallies followed by shallow retracement which signifies robust price structure as the recent up -move is larger (14 % ) as compared to that observed in previous month ( 9 % ) . Additionally, the declines are getting shallower as the recent decline is of 4 . 6 % as compared to 5 . 6 % observed in Mar -25 . Moreover, the Bank Nifty is showing resilience as compared to the benchmark as it witnessed faster pace of retracement where it regained previous 6 months of decline in less than 2 months, indicating structural turnaround . Furthermore, the index broke out of an eight -month falling trendline and surpassed its lifetime high, indicating robust structure .

* In tandem with the benchmark index, the Nifty PVT Bank index is showing resilience as compared to the benchmark as it is witnessing slower pace of retracement where it has not even retraced 38 . 2 % in last 12 trading sessions of the sharp up -move seen in preceding 9 sessions of the previous up -move (24400 - 28050 ) . We believe, the ongoing breather is just a temporary pause in the prevailing uptrend and that would act as strong base to gradually head towards the mark of 28050 being the recent swing high . Meanwhile, the immediate support on the downside is placed at 26225 mark, being 50 % retracement mark of the recent up -move (24400 -28050 ) .

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Daily Technical Outlook by Axis Securities Ltd