Nifty immediate support is at 22400 then 22250 zones while resistance at 22700 then 22900 zones - Motilal Oswal Wealth Management

Morning Market Outlook

* The market is expected to open marginally lower due to weak performance in the Asian markets and a sharp decline in the US markets, driven by uncertainty surrounding US trade policies, which may dampen sentiment.

* The US Nasdaq Composite Index dropped by 2.8% overnight and has fallen 10% over the last 11 trading sessions. The market jitters are largely attributed to the unpredictable nature of US trade policies and rapid shifts in policy announcements.

* Asian markets are down by up to 1%, with the Gift Nifty also falling 60 points.

* European markets ended mixed, with the German index rising 1.5%. The European Central Bank (ECB) reduced its key interest rates by 25 basis points to 2.50%, signalling further cuts to support the Eurozone economy.

* Stock and sector-specific movements are likely to continue despite US announced reciprocal tariffs on India, set to be implemented next month.

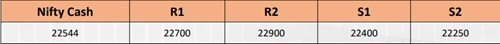

NIFTY (CMP : 22544) :

Nifty immediate support is at 22400 then 22250 zones while resistance at 22700 then 22900 zones. Now it has to hold above 22450 zones for an up move towards 22700 then 22900 zones while supports have shifted higher to 22400 then 22250 zones.

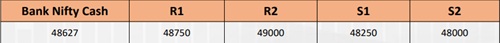

BANK NIFTY (CMP : 48627) :

Bank Nifty support is at 48250 then 48000 zones while resistance at 48750 then 49000 zones. Now it has to hold above 48500 zones for a bounce towards 48750 then 49000 levels while on the downside support is seen at 48250 then 48000 zones.

Derivative Outlook

* Nifty March future closed at 22,620.95 with a premium of 76.25 point v/s 104.05 point premium in the last session.

* Nifty Put/Call Ratio (OI) increased from 1.05 to 1.14 level.

* India VIX increased by 0.40% to 13.72 level.

* On option front, Maximum Call OI is at 23000 then 22500 strike while Maximum Put OI is at 22500 then 22000 strike. Call writing is seen at 22500 then 22800 strike while Put writing is seen at 22500 then 22400 strike. Option data suggests a broader trading range in between 22000 to 23000 zones while an immediate range between 22300 to 22700 levels.

* Option Buying : Buy weekly Nifty 22700 Call if it holds above 22450 zones. Buy Bank Nifty 49500 Call till it holds above 48500 zones.

* Option Strategy : Nifty weekly Bull Call Spread (Buy 22650 CE and Sell 22850 CE) at net premium cost of 60-70 points. Bank Nifty Bull Call Spread (Buy 49000 CE and Sell 49500 CE) at net premium cost of 180-200 points.

* Option Writing : Sell weekly Nifty 21800 PE and 23100 CE with strict double SL. Sell Bank Nifty 46000 PE and 51200 CE with strict double SL.

Fundamental Outlook

Global Market Summary:

* US Markets closed lower as losses in Technology, consumer services and utilities sectors ended lower. CBOE volatility index of S&P 500 options was up 13.4% to 24.87, a new 1-month high

* US President signed orders Thursday to delay the fresh tariffs for Canadian and Mexican imports covered by a North American trade agreement.

* Dow closed 1% lower, S&P 500 lower by 1.8%, while the NASDAQ lower by 2.6%.

* Brent crude oil futures flat at $69.6 per barrel on Friday, nearing a six-month low.

* European markets closed mixed with France and Germany higher while UK was negative

* Dow Futures is currently trading Flat. Asian markets are trading 1.5-2.0% lower.

* Global Cues: Negative

Indian Market Summary:

* Market optimism was driven by positive global cues as US President exempted auto manufacturing companies from 25% tariffs on Canada and Mexico for one month, easing trade tensions to some extent.

* On the domestic front, RBI announced Rs 1 lakh crore OMO purchases and USD/INR Buy/Sell Swap auction of $ 10 billion in March to infuse liquidity into the banking system, which was cheered by the market.

* FIIs: -Rs2,377 crore DIIs: +Rs1,617 crore. GIFT Nifty is trading lower by 21 points (-0.1%).

* Domestic Cues: Flat to Negative

News and Impact :

* Bharat electronics secured an additional order worth Rs 577crore. The major order include airborne electrnoic warfare products and advanced composite communication systems. With this the total accumulated orders received during the current financial year stood at Rs13724cr. Impact: Positive

* Kalpataru projects international has secured new orders worth Rs2306crore. The orders are mainly in the transmission and distribution business in overseas markets and building projects in India. Impact: Positive

Bharat Electronics : CMP Rs 273, TP 360, 24% Upside, Buy

* Additional order worth Rs573 crore secured taking the total accumulated order book to more than Rs13000 cr.

* Bharat Electronics reported stronger-than-expected 3QFY25 results, driven by a robust order book of INR 771b and INR 110b in order inflows during 9MFY25.

* BHE is well-positioned to benefit from defense electronics opportunities, with key orders expected from QRSAM, MRSAM, next-generation corvettes, and P75/P75I.

* We forecast a 19% CAGR in revenue over FY24-27, driven by increased market share and indigenized offerings. BHE's strong cash surplus supports future growth, and we reiterate BUY, based on 35x FY27E earnings.

View: Buy

HPCL : CMP Rs 339, TP490, 31% Upside, Buy

* Lower oil price will keep under recoveries under check while refining margins are likely to remain higher.

* HPCL’s 3QFY25 earnings beat estimates, driven by strong refining margins and robust marketing volumes.

* Key catalysts include LPG under-recovery compensation, the commissioning of the Rajasthan refinery, and the bottom upgrade unit in 4QFY25. Despite potential headwinds from reduced Russian crude usage, HPCL’s GRM remains resilient. Marketing margins are strong, and the capex cycle is tapering, improving ND/E to 1.1x by FY26.

* Trading at 1.2x FY26E P/B with an RoE of 17.3%, valuations are attractive. Reiterate BUY, reflecting upside from operational improvements and potential value unlocking.

View: Buy

Quant Intraday Sell Ideas

What is this?

Based on technical indicators this strategy gives 2 stocks that have a high likelihood to fall during the day (from open to close). This is an intraday Sell strategy which can provide a good cushioning during a black swan event.

What are the rules?

* Stock names will be given at market open (9:15 am)

* Recommended time to entry: between 9:15 to 9:30 am.

* Entry: We short 2 stocks daily (intraday)

* Exit: we will exit at 3:15 as this is an intraday call

* SL: is placed at 1% of the open.

* Book profit: At 1% fall since open.

* In special situations the book profit might be delayed if the stock is in free fall.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Quote on Market from Vipul Bhowar, Senior Director - Listed Investments, Waterfield Advisors