Weekly Derivatives Insights - Axis Securities

The Week That Was:

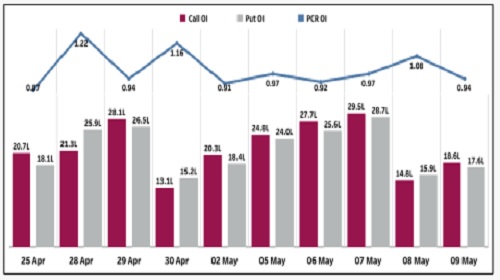

* Nifty futures closed at 24,065.5 on Friday, dropping 1.4% with a 1.7% increase in open interest, indicating building of Short positions.

* Bank Nifty futures settled at 53,732, tumbling 2.7% with a 17% decrease in open interest, as Long positions were liquidated.

* India VIX rose 18.5% and settled at 21.6 as the demand for protection rose.

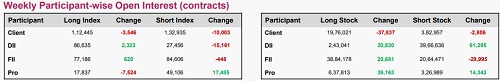

* FII long-short ratio in index futures remained stable at 0.91 as long positions were created and short positions were reduced in a bullish turn.

* Total outstanding open interest in Nifty and Bank Nifty futures were 1.49 cr units (prev: 1.47 cr) and 0.21 cr units (prev: 0.25 cr), respectively.

Nifty Open Interest Put-Call Ratio

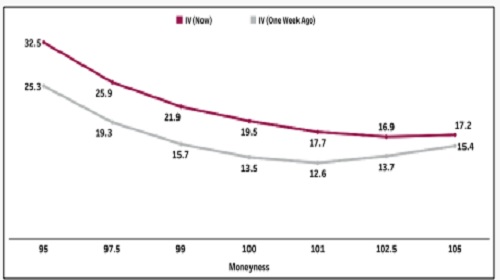

Volatility Analysis

* The implied volatility curve shifted lower last week, which means as of Friday, market participants were expecting the upcoming week to have a smaller range of swings based on options set to expire on May 8

* Additionally, implied volatility for 2.5% OTM calls fell more than the drop seen in IV for similar-distance puts, which meant that expectations are for the market to experience profit-booking at higher levels.

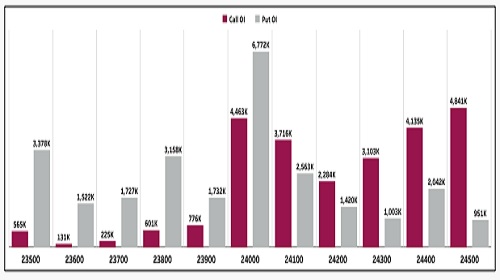

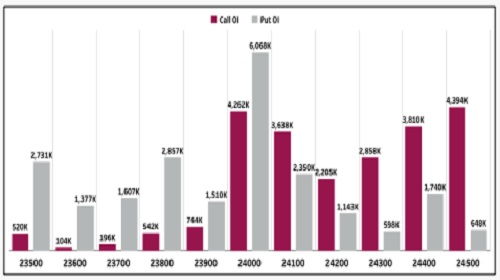

Nifty Open Interest Concentration (Weekly)

* The strike-concentration for the upcoming expiry on May 15 shows that the Nifty has strong supports at 24,000, 23,800 and 23500 while resistance can be seen near 24,500, 24,400 and 24,600.

* Speaking open interest change, the 24000-strike call and put saw the maximum addition alongside the 23800-strike put and the 24500-strike call.

* Based on the data, we project the Nifty to trade between 23,800 and 24,500 in the week ahead.

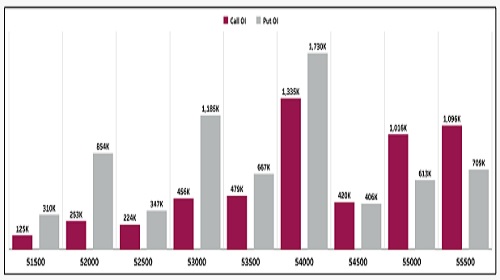

Bank Nifty Open Interest Concentration (Monthly)

* The strike-concentration for May expiration shows that the Bank Nifty has strong supports at 53,000, 52000 and 51,000 while resistance rests at 54,000, 55,000 and 56,000.

* Speaking open interest change, the 54000-strike call and put saw the maximum addition while the 55000- strike put saw the biggest unwinding.

* Based on the data, we project the Bank Nifty to trade between 52,000 and 55,000 in the coming week, with 54000 acting as a pivotal level.

Nifty Change in Open Interest (Weekly)

* Using the monthly expiration cycle, notable addition in calls was seen at the following strikes - 24,800 (14.5 Lc), 25,000 (8.3 Lc), and 24,500 (7.4 Lc), respectively. Significant unwinding was observed at the 25,300 & 25,500 strikes.

* Coming to puts, the 24,000 (6.8 Lc), 23,000 (5.6 Lc), and 23,100 strikes (5.7 Lc) saw considerable addition in open interest. Unwinding was witnessed at the 23,500 strike.

Bank Nifty Change in Open Interest (Monthly)

* For the Bank Nifty - based again on the monthly expiration cycle - notable addition in calls was seen at the following strikes - 54,000 (9.9 Lc), 54,500 (2.3 Lc), and 55,000 (2.9 Lc), respectively. Significant unwinding was observed at the 53,000 strikes.

* Coming to puts, the 54,000 (5.7 Lc), 54,400 (0.6 Lc), and 53,600 strikes (0.6 Lc) saw considerable addition in open interest. Significant unwinding was observed at the 53,000 and 53,500 strikes.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

The Index can be long if it sustains above 24850 for the potential target of 24950 & 25100 w...