Neutral Mahindra Logistics Ltd For Target Rs.330 by Motilal Oswal Financial Services Ltd

In-line operational performance; higher interest and tax outgo dent APAT

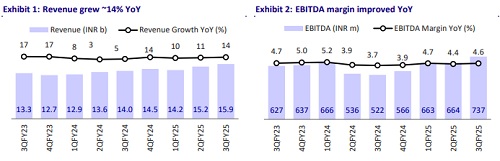

* Mahindra Logistics (MLL)’s revenue grew ~14% YoY to INR15.9b in 3QFY25, in line with our estimate.

* EBITDA margin came in at 4.6% (+90bp YoY and +20bp QoQ) vs. our estimate of 5%. EBITDA rose 41% YoY to INR737m vs. our estimate of INR788m.

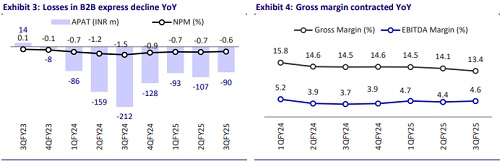

* Adjusted net loss narrowed to INR90m in 3QFY25 from INR212m in 3QFY24 (our estimate of INR116m profit).

* During 9MFY25, revenue stood at INR45.3b (+12% YoY), EBITDA was INR2.1b (+20% YoY), and EBITDA margin came in at 4.5%. Adj. loss stood at INR291m (vs. loss of INR457m).

* Supply Chain management recorded revenue of INR15.1b (+15.5% YoY) and EBIT loss of INR18.8m. Enterprise Mobility Services (EMS) reported revenue of INR781m (-6.9% YoY) and EBIT of INR7.6m.

* Revenue growth was driven by strong performance in 3PL contract logistics, outbound logistics, and last-mile delivery, despite macroeconomic challenges and pricing pressures in road logistics and air freight. While the B2B express and enterprise mobility businesses faced declines, MLL remained focused on cost optimization, retail volume growth, and EBITDA breakeven in B2B express within two quarters.

* While MLL’s operational performance was in line, the express business has been struggling. We cut our EBITDA estimates by 1-6% in FY25-27 to factor in the weak performance and delayed breakeven in the express business. We estimate a CAGR of 20%/30% in revenue/EBITDA over FY24-27. Reiterate Neutral with a revised TP of INR330 (premised on 15x Sep’26E EPS).

Order intake in contract logistics remains strong; last mile and warehousing continue to perform well

* The company expanded its transportation and green logistics offerings, along with a strong order intake of INR1b the contract logistics business. The growth in contract logistics business was impacted by softness in end markets, lower customer volumes after Oct’25, and delayed contract closures.

* B2B express business revenue declined 9% YoY due to operational challenges and seasonal impacts, but a higher order intake in 3Q is expected to aid recovery ahead.

* The last-mile delivery segment achieved strong growth of 80% YoY, driven by the Whizzard consolidation and improved margins, while the crossborder segment grew 19% YoY despite a decline in ocean freight volumes due to pricing corrections.

* MLL expanded transportation and green logistics offerings while strengthening network infrastructure, especially in the East, to support warehousing, last-mile, and express services for future growth.

Highlights from the management commentary

* Volume growth in B2B Express Business was impacted by customer churn and a lower-than-expected win ratio. Cost-leverage benefits fell short of expectations, but a higher order intake in 3Q is expected to support volume recovery in the coming quarters.

* The company has seen improvement in volumes in Jan’25. Seasonal challenges and pricing competition continue to pose short-term hurdles. Management remains focused on expanding retail volumes, enhancing partnerships, and launching new offerings.

* The company expanded its transportation and green logistics offerings and progressed on new warehousing developments in western and eastern India, with over 70% capacity already sold out.

Valuation and view

* The losses in the express business are anticipated to decrease as volumes grow, which should enhance MLL's overall EBITDA. However, there would be a delay in the breakeven considering the industry-wide slowdown and heightened competition.

* We cut our EBITDA estimates by 1-6% for FY25-27, due to weak performance and delayed breakeven in the express logistics business. We estimate a CAGR of 20% in revenue and 30% in EBITDA over FY24-27. We reiterate our Neutral rating with a revised TP of INR330 (premised on 15x Sep’26E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412